Hong Kong based Fintech Neat has received USD $3 million in funding led by China-based VC firm Linear Capital. Neat is a bank alternative and claims to already have customers in more than 100 countries, delivering a fully digital alternative to a traditional bank account. Neat has now raised a total of USD $5 million during 2018. Existing investors including Dymon Asia Ventures, Portag3 Ventures and Hong Kong-based Sagamore investments.

“We are excited to make our Neat Business product available to Chinese customers who are looking for a Hong Kong based solution to help realize their global ambition”, stated David Rosa, CEO and co-founder of Neat. “Today we are seeing more enterprises – new and established – from China venturing beyond their domestic market and Neat is perfectly positioned to offer this growing group of businesses financial access and the ability to expand their footprint globally.”

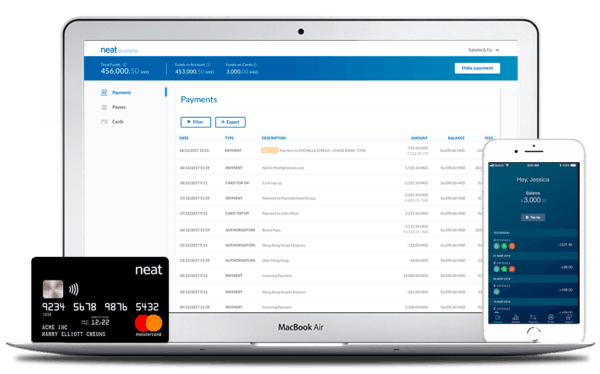

Neat Business offers a multi-user business account, along with Mastercard debit cards, that provides businesses around the world with a dedicated Hong Kong bank account number. Neat says it takes just 10 minutes to sign up online. Users may make payments and make international transfers to more than 60 countries. Neat says it “makes bank branches redundant.”

Harry Wang, CEO and founder of Linear Capital, said the digital revolution is transforming financial services. Neat will deliver an essential solution to Chinese businesses that are looking to go global, says Wang:

“We are thrilled to be able to support Neat in growing its presence with Chinese customers and look forward to leveraging the company’s strong Fintech background coupled with its solid Know Your Customer (KYC) solution to serve the needs of young enterprises in China.”

Neat says that for any business going global opening a bank account abroad can be a challenge. Neat offers a superior, faster and more flexible alternative to a traditional corporate bank account for companies.

Rosa is presenting at the forthcoming Hong Kong Fintech Week. His topic of discussion is “The Rise of Challenger Banks.”