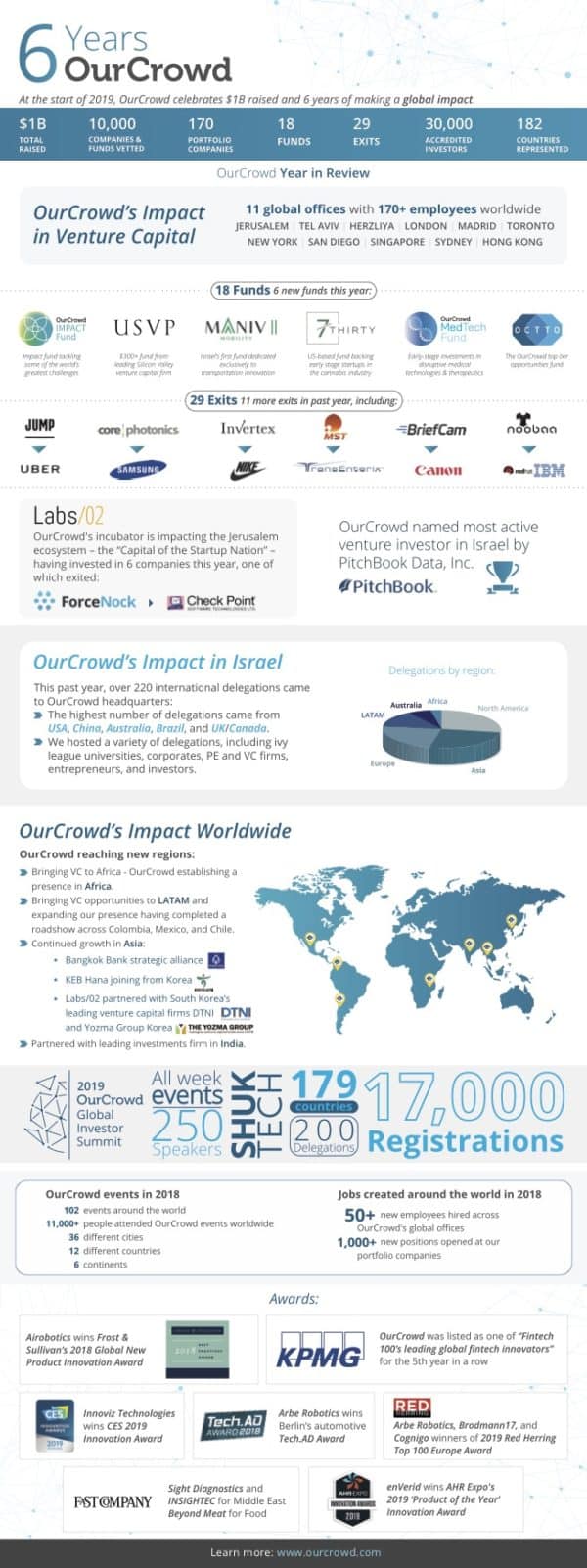

OurCrowd, the largest investment crowdfunding platform in the world, has topped $1 billion in funding raised. The online investment platform has provided growth capital to 170 individual firms and 18 different funds in the six years since the platform launch.

Alongside the milestone funding amount, OurCrowd has reported 29 separate exits for firms that have raised capital via their site.

OurCrowd is unique in the fact that it invests in every single company raising money on their platform. Thus, their interests are aligned with smaller investors. Simultaneously, OurCrowd provides extensive support for these firms by mentoring, making introductions to potential partners and facilitating introductions to multinational firms. OurCrowd is highly motivated to drive the success of these early stage companies.

OurCrowd has also been recognized as Israel’s leading venture investor in the hot startup market that has captured the attention of the entire world and its “innovation nation” status.

In a release, OurCrowd founder and CEO Jon Medved said they have built a model for the investor community that “democratizes access to incredible companies.” OurCrowd is a prime example of what online capital formation can accomplish by providing access to high-quality deals for smaller (accredited) investors.

Currently, over 30,o0o registered investors are signed up on the OurCrowd platform. These individuals represent over 150 different countries.

“It’s working,” said Medved. “The synergy we’ve created between investors, companies and venture funds has allowed us to play an instrumental role in building Israel’s reputation as a global leader in innovation and technology.”

OurCrowd states that geographically, the company’s primary investor base remains the United States. The US has historically been the largest venture market in the world. But Asia is in second place as the market in China, and elsewhere around the region, has boomed.

OurCrowd states that geographically, the company’s primary investor base remains the United States. The US has historically been the largest venture market in the world. But Asia is in second place as the market in China, and elsewhere around the region, has boomed.

Data provided by OurCrowd indicates that the average number of investments made by an individual is currently seven. The average portfolio size is just over $350,000.

OurCrowd states that 2018 was a year of “enormous growth,” which solidified its “place in the venture capital ecosystem.”

OurCrowd’s 18 different funds provides individuals access to venture investments combined with the benefits of diversification and professional management.

This week, OurCrowd is launching two unique venture funds:

- OurCrowd Impact Fund (venture-backed businesses solving some of the world’s greatest challenges);

- OurCrowd’s Medtech Fund (innovative medical technologies and therapeutics).

Additional funds include: Oxx (growth stage European B2B SaaS); 7thirty Opportunity Fund (early stage cannabis tech fund) and; ADvantage (global sports tech).

Medved said that while they are excited about platform growth it sets a high bar for 2019:

“On our marathon journey, each time we reach a summit, we catch our breath and look up and realize the further peaks yet to scale.”

Highlights during the year include:

Investments in 24 new companies, including:

- AlphaTau Medical: new radio therapy for solid cancer tumors

- C2A: cybersecurity for connected vehicles

- Beyond Meat: Develops and manufactures a plant-based meat subtitute.

- Insightec: MR-guided focused ultrasound for non-invasive surgery

- MeMed: preventing misuse of antibiotics

- skyTran: new form of urban travel

- ThetaRay: AI-based detection and protection against financial fraud

- Data.world: Enables users to easily collect and integrate data

For 2018, OurCrowd bulleted out the following accomplishments:

- 11 of its companies achieved an exit, including;

- Corephotonics’ acquisition by Samsung;

- Jump Bikes’ acquisition by Uber;

- Invertex’s acquisition by Nike;

- BriefCam’s acquisition by Canon;

- MST’s acquisition by TransEnterix

- NooBaa’s acquisition by Red Hat Inc./IBM

- OurCrowd’s operations expanded with 3 new offices in Israel including Tel Aviv, Herzliya, and Jerusalem. Total physical locations stand at 11 offices worldwide including London, Madrid, Toronto, New York, San Diego, Singapore, Sydney, and Hong Kong

- The rapid growth of the investment platform necessitated addition hires of 50+ new employees. This was joined by 1,000+ new positions opened at portfolio companies thus showing the job growth affiliated with the platform’s investments.

- In addition to its Global Investor Summer, OurCrowd held over 102 events around the world in 36 different cities.

- Launched Labs/02 seed stage incubator, which invested in 6 early-stage companies including ForceNock, which was acquired by CheckPoint Software. Labs/02 partnered with South Korea’s leading venture capital firms DTNI and Yozma Group Korea.

- OurCrowd was recognized as one of Fintech 100’s Leading Global Fintech Innovators for the 5th consecutive year.

- The OurCrowd Global Investor Summit is the largest technology showcase in Israel with over 170 startups and 17,000 registered attendees.