Accredited investors who bought into Telegram’s $1.7 billion USD ICO (initial coin offering) in February and March 2018 have been selling the tokens in secondary markets without authorization, meaning buyers could “end up with nothing,” Coindesk reports.

Accredited investors who bought into Telegram’s $1.7 billion USD ICO (initial coin offering) in February and March 2018 have been selling the tokens in secondary markets without authorization, meaning buyers could “end up with nothing,” Coindesk reports.

According to a GRAM token purchase agreement obtained by the outlet, first-round buyers of GRAMs agreed to observe a “Restricted Period” during which they would not, “offer, pledge, sell, contract to sell…encumber or dispose of their tokens…directly and indirectly.”

Selling, “any securities convertible into or exercisable or exchangeable for the investment contract,” is also forbidden in the purchase agreement, which was drafted by major American law firm Skadden, Arps, Slate, Meagher & Flom LLP.

Telegram prohibited the trading of GRAMs until the blockchain it is building for their circulation, Telegram Open Network (TON), has been completed, and according to a source to Coindesk, “Telegram was the first big project that legally prohibited investors from selling their allocation.”

The prohibition may have been established to keep the company on the right side of regulators, who have become increasingly active in response the ICO boom of 2017.

Researcher Larry Cermak noted in a recent thread of tweets that, currently, “The median ICO return in terms of USD is -87% and constantly dropping.”

The contractual prohibition on resale fo GRAM tokens hasn’t stopped first round investors, who bought the tokens at $0.37 USD in the first round and $1.33 in the second, from “gifting” tokens to friends or otherwise transferring them.

The Japanese crypto exchange Liquid, in partnership with “GRAM Asia,” sold GRAM tokens to the public in July of this year for $4 each.

Telegram has stated that GRAM Asia is not an official partner.

Crowdfund Insider and other outlets covered the sale, and none of those reports mentioned the resale prohibition in the original GRAM token Purchase Agreement, suggesting that Liquid may not have been explicit about informing investors or the press about the prohibition- and the risks.

Telegram will not be issuing GRAMs until the TON blockchain is operational, meaning the tokens being sold by Liquid/GRAM Asia are also not available for custody by purchasers until they are transferred to Liquid et al and then to buyers- if they are indeed transferred.

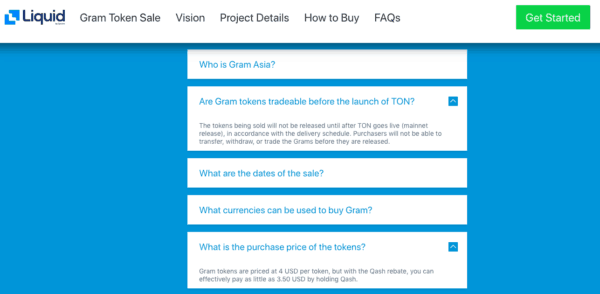

Liquid makes a brief reference to GRAM token trading restrictions on the website page dedicated to the GRAM sale:

“The tokens being sold will not be released until after TON goes live (mainnet release), in accordance with the delivery schedule. Purchasers will not be able to transfer, withdraw, or trade the Grams before they are released.”

…but does tell investors that the tokens could be nullified.

Tokens sold by GRAM Asia and Liquid are not available to investors in Japan or the US.

According to Coindesk:

“Purchasing tokens this way might be risky, investors warn, as Telegram specifically prohibited investors from re-selling their allocations under penalty of terminating the purchase contract.”

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!