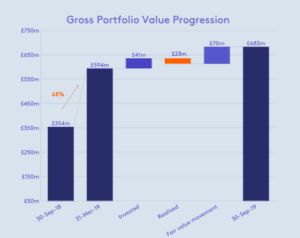

Draper Espirit (LSE:GROW.L), the Europe-focused tech investment firm, has recently posted interim results as of September 30, 2019. According to Draper Esprit, the company remains on course to achieve its stated goal of delivering a portfolio return of 20% for the full year, having generated a 12% gross fair value increase during the first six months of the current year.

Draper Espirit (LSE:GROW.L), the Europe-focused tech investment firm, has recently posted interim results as of September 30, 2019. According to Draper Esprit, the company remains on course to achieve its stated goal of delivering a portfolio return of 20% for the full year, having generated a 12% gross fair value increase during the first six months of the current year.

Draper Esprit is one of the most active VCs in Europe. The publicly traded VC firm notes that venture capital as an asset class has outperformed public market benchmarks each decade since 1970. This is amplified by the fact that investments in private markets have grown in recent years as public markets have declined.

The company believes that while much of the growth in private markets is in later stage rounds there is better opportunity in early-stage investments.

Using Uber as an example, Draper Esprit invested in the Series A, B, C rounds of the ride-share company. During the Series A round, Uber’s valuation stood at just $49 million. By the Series C round, Uber had jumped to $3.4 billion in valuation.

When Uber went public at a valuation of $67.61 billion – public investors got caught holding the bag as shares immediately tanked due to its overambitious valuation. Later venture investors experienced little to no gain. Today, Uber’s valuation is around $50 billion. Draper Esprit nailed it while public investors got crushed.

These results have been aided, in part, due to some prominent investments in Fintechs. Draper Esprit’s portfolio companies include Revolut, N26, Transferwise and more.

Draper Esprit has invested £7 million in digital challenger bank Revolut which holds a £17 NAV as of September.

Transferwise received £6 million and the NAV has more than doubled to £13 million as of September. Draper Esprit sold a portion of their shares in Transferwise in May but it remains a portfolio holding.

Draper Esprit benefits from having access to the best investment opportunities while holding a highly diversified portfolio of investments. While past results are never a guarantee of future returns, for the foreseeable future – earlier stage investments are generating far higher returns than later-stage opportunities and publicly held companies.