Part 6 of a series of articles covering the fast-emerging Fintech ecosystem in Latin America.

When we look at Latin America’s Fintech scene, it conjures up memories of the U.S. Fintech evolution that took place during the past decade. Or perhaps, the past decade and a half, depending on your perspective.

The phrase “Wild Wide West” was often uttered by just about everyone involved in innovation in financial services in North America. That phrase was also spoken with an abundance of caution. Innovators and entrepreneurs, along with investors, knew that regulation was coming. They also knew it was needed.

The folks that took the long view and pursued a compliant path leveraging existing banking regulations as a guide – have survived. Those that were taking advantage of the inefficiencies in the market may have made their money but ultimately got out of the business seeking yield elsewhere.

Now, certainly in North America, regulation has taken hold in the realm of Fintech innovation. From my unscientific survey, half of the folks that I talk to moan and groan about the rules and the other half have learned to live with the new regulatory environment by iterating and reinventing their businesses to stay compliant and hopefully profitable.

Regulation, and the need to be compliant, has arrived in Latin America. Some of the “city-states” within larger Latam countries have already had bespoke Fintech regulations passed within their jurisdiction. Others may be on the way.

Most Fintech entrepreneurs are fairly open and vocal about their opinion in the new regulatory world. As noted in my earlier reports on Latam Fintech, some folks, depending on the country, are openly criticizing regulators’ heavy-handed approach to Fintech which may have left little room for innovation or competition against the incumbent banking system.

Politics aside, I think all of my readers have seen this plot played out many times in their careers.

Learn From Our Past

Latin America has advantages, as well as challenges, confronting Fintech innovators. At times, Fintech entrepreneurs must manage relatively basic infrastructure or challenging national legal systems. Fintechs must strike a balance of maintaining their culture and national characteristics while managing outside investors and foreign influence.

However, when we look at the fundamental challenges of compliance, customer service, consumer privacy issues, it is universal and we shouldn’t look past, or be afraid of learning from, those companies that have operated in the market for many decades.

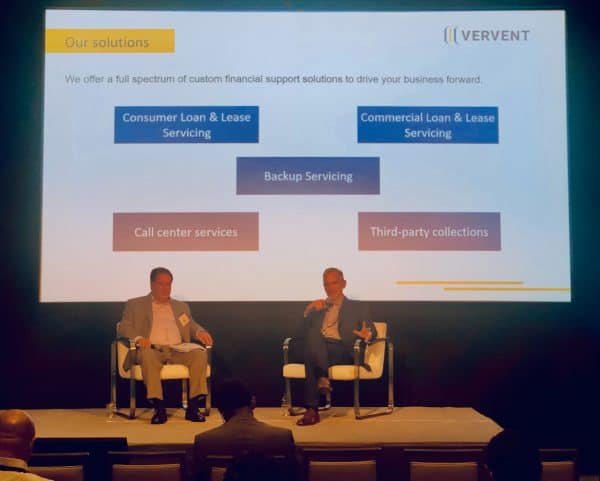

Take Vervent, for example, an A.I. driven compliance and servicing company based in California. They have been leveraging A.I. (Artificial Intelligence) and perfecting their models for the past six years. The company helps its clients to achieve efficiency and profitability – while remaining compliant.

Combining technology, expertise and industry know-how from firms like First Associates, and PFSC, Vervent has emerged as the advanced servicing company across many regions of the world.

“One of the greatest benefits of AI is increased efficiency,” says David Johnson, CEO of Vervent. “For example if a competitor has 30,000 loans to verify it would take them 6-8 days. At Vervent, using AI with speech analytics, that same project takes only hours and delivers a higher level of accuracy while using reduced resources.”

Vervent is leveraging A.I. technology to scan through thousands of documents in a matter of hours as part of their investor custodial services – a process that typically takes days to complete. Vervent profoundly accelerates the approval process for investors while freeing up funds faster for lenders to deploy to their customers.

A.I., as we know, doesn’t get tired, nor calls off sick, and it’s consistent in its decision making. These characteristics make it easier for lenders to stay compliant by avoiding costly mistakes by human operators.

A.I. In Speech Recognition

In the old days, we often had to employ an entire compliance team to monitor phone calls. We also had to constantly retrain these same employees while putting together “defect reports” for management to deliver the correct action plan.

As lenders grow their loan portfolios, there is an emergence of multiple customer interaction points where we must deploy technology to help us analyze text, speech, email and more. Companies like Vervent have been leveraging speech recognition and A.I. algorithms to monitor all call center conversations. Prior to incorporating A.I., the call center compliance staff was sizable and had to complete very time-consuming tasks like sampling calls – not a very efficient process. With A.I., a company can efficiently scan through 100% of their calls while remaining compliant within the law.

Vervent is taking their process further and is now sharing additional findings with clients. Their A.I. is deriving insights from these conversations to learn from their clients’ demands which enables a process of iteration and updating based off of user data.

Are they confused about payments? Or Are they happy about their experience? What do they really need?

In Fintech, this information is key to helping originators and lenders evolve and perfect their craft.

Learn From Your Neighbors

LendIt Fintech’s next conference will be held in New York on May 13-14th 2020. I courage those that came to the LendIt Miami event to join us in New York and start a conversation with lenders, vendors, servicer and investors to learn from our successes and mistakes.

And of course, the 2nd annual Latin America Fintech show will be held again in Miami in Dec 2020. Looking forward to seeing you all there and witness the growth of Fintech in Latin America.

I know you have all been waiting for my write up on the VISA Everywhere Pitch Competition. It’s coming right up in Part 7 of my Latin America Fintech series.

Timothy Li is a Senior Contributor for Crowdfund Insider. Li is the Founder of Kuber, MaxDecisions, an Alchemy. Li has over 15 years of Fintech industry experience. He’s passionate about changing the finance and banking landscape. Kuber launched Fluid, a credit building product designed for college students to borrow up to $500 interest-free. Kuber’s 2nd product Mobilend is a true debt consolidation product, aiming to lower debt for all Americans. MaxDecisions provides financial institutions with the latest A.I. and Machine Learning algorithms and Alchemy is a state of the art end-to-end white-labeled lending platform powering some of the best Fintech companies in the world. Li also teaches at the University of Southern California School of Engineering.