Payments platform Paysafe is out with some research on changes in the shopping ecosystem during the COVID-19 pandemic and it should come as no surprise their numbers indicate e-commerce is booming. Paysafe processes about $85 billion annually in 40 different currencies.

Surveying over 8,000 consumers from the US, UK, Canada, Germany, Austria, Italy, and Bulgaria, Paysafe reports that, overall, 42% of consumers are shopping online much more.

One-third of respondents said they are shopping online for products they did not really need prior to the Coronavirus crisis. US consumers are the most affected as 54% of US shoppers transact online because they cannot visit physical stores. 46% are making specid COVID-19 related purchases.

The shift in purchases is not dissimilar in other markets but regional differences do play a role. In Germany, 31% of consumers are shopping online and 32% in Austria.

While it is hard to imagine there are still people who do not make online transactions, Paysafe says that, globally, 18% of consumers are now shopping online for the first time due to COVID-19.

In the US specifically, the percentage is 25% and it is 21% in the UK.

COVID-19 may end up being another nail in the coffin of some brick and mortar retailers as 38% of consumers say they are planning to shop more online following the pandemic due to convenience (65%) and enjoyment (42%).

On the flip side, some respondents are concerned about reliability and fraud.

According to the report, 42% of consumers say they would shop online more but are concerned about their items being delivered. And 41% of consumers are limiting their online shopping out of concern for being the victim of fraud.

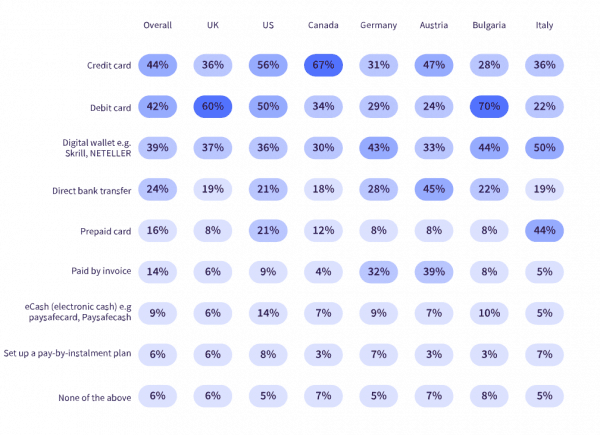

Credit cards are the most popular method of online payment in Canada (67%) and the US (56%).

Card payments are also popular in the UK and Bulgaria with a greater percentage of consumers in the UK (60%) and Bulgaria (70%) paying with a debit card instead.

Only a third of consumers in Germany (31%) and Austria (32%) are shopping online more due to lack of access to stores, and even fewer are shopping for COVID-19 specific items online (26% in Germany; 20% in Austria).

So is this an enduring shift to digital shopping? Perhaps.

And what about cash? Are consumers willing to forgo physical currency as it can be inconvenient and rather dirty?

It appears that people still want the option to hit the ATM and stuff paper into their wallets. The report states that 72% of consumers would be worried if cash went the way of the horse and buggy. Half of the surveyed consumers still believe that cash is the most reliable form of payment during a crisis. Regionally, consumers in the US (60%), Bulgaria (53%), and Germany (52%); over half of all consumers in these markets believe cash is the most reliable method of payment in a crisis.

Daniel Kornitzer, Chief Business Development Officer at Paysafe, says this unprecedented time is making many North American consumers re-evaluate their attitudes to online payments, in what will likely be a permanent change.