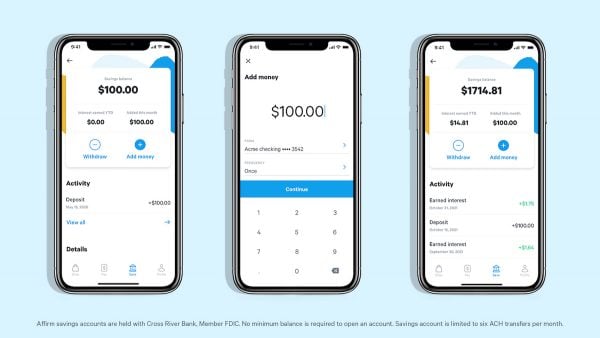

Affirm, a Fintech founded by vaunted entrepreneur Max Levchin, announced on Monday the launch of its high-yield saving account. As previously reported, Affirm is a point of sale credit provider that is currently working with over 2000 merchants. The company’s goal is to provide shoppers with an alternative to expensive credit cards at the point of sale, giving them the flexibility to buy now and make simple monthly payments for their purchases. Levchin states:

“We’re here to improve lives. If that means more work for us, or that we make less money, we will always take the more difficult path in favor of treating people better.”

“Affirm started by creating a simple, transparent form of credit that allows consumers to split the total cost of a purchase over monthly payments, without ever charging late or hidden fees. Today, 5.3 million consumers trust that we’re a better way to pay. Now, consumers get the same transparency in a savings account, so they can save more, faster.”

Affirm Savings account features the following:

- 1.30% APY

- No minimums or fees, ever

- Optional auto-deposit to make saving effortless

- Affirm Savings is FDIC-insured and accounts are held by Affirm’s bank partner, Cross River Bank