The Singapore Exchange (SGX) has completed a digital bond issuance in partnership with Temasek and HSBC. The security was issued via SGX’s digital asset issuance, depository, and servicing platform and is the first type of offering completed by the exchange.

According to a note posted by SGX, the digital asset offering marks a first step towards utizliation of smart contracts and distributed ledger technology (DLT) for the Asian bond marketplace. The pilot is said to have successfully replicated a S$ 400 million 5.5-year public bond issue along with a follow-on of S$100 million by Olam International.

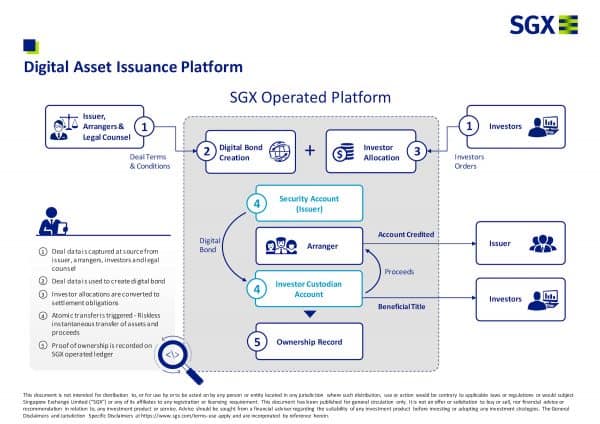

DLT technology streamlined the process for investors, issuers and other participants in the securities offering ecosystem.

SGX utilized DAML, the smart contract language created by Digital Asset, for issuance and asset servicing over the bond’s lifecycle.

SGX’s solution uses smart contracts to capture the rights and obligations of parties involved in the issuance and servicing of the security.

The digital bond used HSBC’s on-chain payments solution for settlement in multiple currencies to facilitate transfer of proceeds between the issuer, arranger and investor custodians.

SGX said it will work with issuers, arrangers, custodian banks, and investors to digitalize bond issuance, depository, and asset servicing, progressively growing the fixed income ecosystem.

Lee Beng Hong, Senior Managing Director, Head of Fixed Income, Currencies and Commodities (FICC), SGX, stated:

“We are very excited that this collaboration with HSBC and Temasek has led to the successful completion of the first digital syndicated public corporate bond in Asia. Debt capital markets globally are characterised by deeply engrained legacy systems and processes which can be made faster, more accurate and efficient with this new technology. DLT and smart contracts are rapidly evolving technologies, and our vision is to fully digitalise the end-to-end corporate bond Page 2 issuance and asset servicing process. We look forward to playing a part in strengthening the fixed income market infrastructure of Singapore, Asia’s fixed income hub for bond issuers.”

David Koh, Head of Global Liquidity and Cash Management, HSBC Singapore, said they are proud to be working closely with SGX and Temasek to drive faster and fully secure settlements for bond offerings.

“This first digital bond issuance for Olam International shows how our on-chain solution can fulfill payment needs in DLT-based ecosystems, and demonstrates our desire to shape and participate in the next generation of asset networks, to better service our securities services clients. We look forward to bringing this technology to our clients in Singapore and beyond.”

Chia Song Hwee, Deputy Chief Executive Officer at Temasek, said technologies such as blockchain technology can transform processes and systems to create game-changing opportunities.

Yuval Rooz, co-founder and CEO, Digital Asset, said that despite the growth in electronic bond trading, there are still many aspects that require manual intervention. Rooz said that SGX’s DAML smart contract solution solves a major pain point market participants have been working to fix for years.

Yuval Rooz, co-founder and CEO, Digital Asset, said that despite the growth in electronic bond trading, there are still many aspects that require manual intervention. Rooz said that SGX’s DAML smart contract solution solves a major pain point market participants have been working to fix for years.

“We look forward to our continued work with SGX as they move to digitise the end-to-end bond issuance process.”

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!