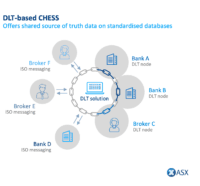

DLT, Smart Contracts: DAML for Azure Database Enables Clients to Deploy Multiparty Apps on Microsoft’s Cloud Infrastructure

DAML for Azure Database enables customers to “deploy multiparty applications on Microsoft’s powerful cloud infrastructure immediately.” Businesses are using distributed ledger platforms “to deploy multiparty applications even though many wish they could simply leverage familiar infrastructure to improve complex business processes that don’t require overhauling… Read More

Read more in: Blockchain & Digital Assets, Global | Tagged daml, digital asset, microsoft azure, product update, smart contract, smart contracts