U.S. fintech Affirm announced on Thursday it secured $500 million through its Series G investment round, which was led by GIC and Durable Capital Partners LP. Other returning investors include Lightspeed Venture Partners, Wellington Management Company, Baillie Gifford, Spark Capital, Founders Fund, and Fidelity Management & Research Company LLC.

As previously reported, Affirm is a point of sale credit provider that is currently working with more than 5,000 merchants, including Article, Joybird, West Elm, and Shopify. The company’s goal is to provide shoppers with an alternative to expensive credit cards at the point of sale, giving them the flexibility to buy now and make simple monthly payments for their purchases.

As previously reported, Affirm is a point of sale credit provider that is currently working with more than 5,000 merchants, including Article, Joybird, West Elm, and Shopify. The company’s goal is to provide shoppers with an alternative to expensive credit cards at the point of sale, giving them the flexibility to buy now and make simple monthly payments for their purchases.

Affirm reported it has raised more than $1.3 billion from investors to date. While speaking about the latest round of funding, Max Levchin, CEO and Founder of Affirm, stated:

“We’re excited about this vote of confidence from both new and existing investors as we advance our mission to build honest financial products that improve lives. Alongside this new capital, our latest product is another step towards becoming as ubiquitous as credit cards – Affirm is now an even more attractive payment option for everyday wants and needs. We can also now better support merchants who offer smaller ticket items and bring their customers a more transparent, flexible way to pay.”

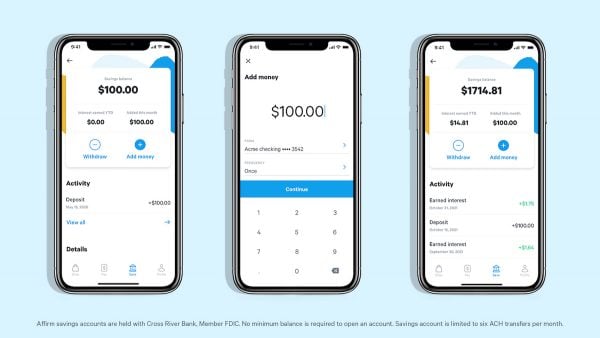

Along with the investment round, Affirm announced it is introducing an interest-free biweekly payment product for transactions as low as $50. As with the company’s existing monthly payment options, consumers will never be charged late or hidden fees when using this new product.

“By offering Affirm, our 6,000 merchant partners can drive overall sales, grow average order value (AOV), and increase repurchase rates. In 2019, merchants using Affirm reported 85% higher AOVs when compared to other payment methods, and 67% of Affirm purchases were from repeat users.”

“We’re excited about this vote of confidence from both new and existing investors as we advance our mission to build honest financial products that improve lives. Alongside this new capital, our latest product is another step towards becoming as ubiquitous as credit cards – Affirm is now an even more attractive payment option for everyday wants and needs. We can also now better support merchants who offer smaller ticket items and bring their customers a more transparent, flexible way to pay.”

“We’re excited about this vote of confidence from both new and existing investors as we advance our mission to build honest financial products that improve lives. Alongside this new capital, our latest product is another step towards becoming as ubiquitous as credit cards – Affirm is now an even more attractive payment option for everyday wants and needs. We can also now better support merchants who offer smaller ticket items and bring their customers a more transparent, flexible way to pay.”