Yapily, a UK-based open banking infrastructure provider, announced on Tuesday it has appointed Martin Threadkall as its new COO. According to Yapily, Threadkall brings more than a decade of growing payment startup and scale-up businesses expertise.

Prior to joining Yapily, Threadkall was notably the Co-Founder and Chief Operating Officer at Modulr, a Payments-as-a-Service API platform, where he led the various functions within operations, including Payment Operations, Compliance, and Legal, Customer Services, Banking Relationships, as well as the European side of the business.

Speaking about his new position, Threadkall stated:

“I’m excited to join the team at this critical time for growth. Yapily offers market leading technology that is far ahead of its competition, which is why they are the experts when it comes to Open Banking. And as we head into 2021, I’m excited to join the team and help them continue to thrive in the next normal.”

Stefano Vaccino, CEO for Yapily, added:

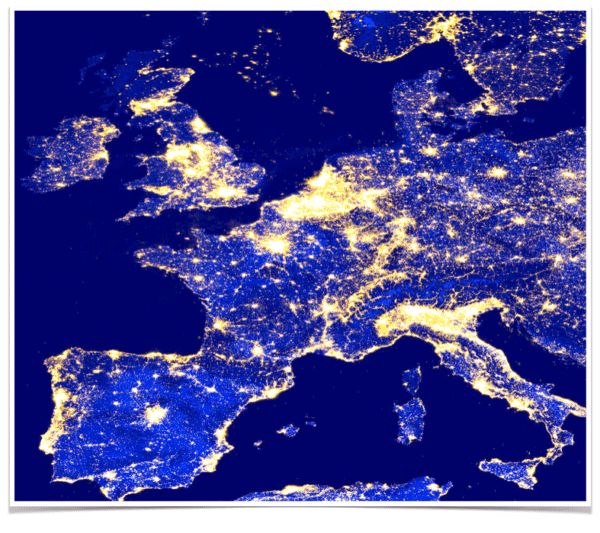

“Bringing together leading experts to supercharge growth for Yapily is a top priority, which is why we are delighted to welcome Martin to the team. He joins us with a wealth of valuable experience and will help us continue to scale our business and reach our potential as we execute our European expansion goals.”

As previously reported, Yapily is an enterprise connectivity platform that enables companies to seamlessly access users’ financial data. The company claims it empowers people around the world to receive faster, affordable, and personalized products. The company has raised $18.4 million in funding to date, and over the last six months, monthly recurring revenue has grown over 500%.

“We connect businesses to thousands of banks through a secure open API. Taking care of the complexity and management of connections, saving businesses time and money. As the world moves towards an open economy, we exist to power the innovative solutions that will ultimately transform the way we all interact with financial products and services.”