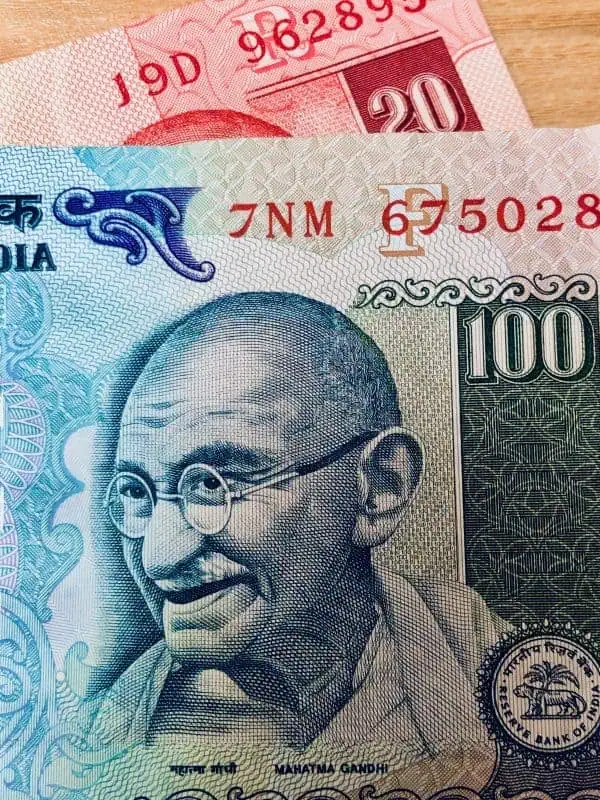

India-based digital payments firm PhonePe has branched out from its parent company, the Walmart-owned Flipkart Group. PhonePe is now valued at an estimated $5.5 billion, the company confirmed on December 3, 2020.

India-based digital payments firm PhonePe has branched out from its parent company, the Walmart-owned Flipkart Group. PhonePe is now valued at an estimated $5.5 billion, the company confirmed on December 3, 2020.

According to the announcement, Flipkart will maintain its own majority stake of 87% in the branched out entity PhonePe Private Ltd., with US-based retail giant Walmart maintaining a 10% stake, while existing investors such as Tiger Global Management keeping the remaining 3%.

PhonePe is notably raising $700 million as part of this deal. The massive investment round will be led by Walmart and will reportedly include participation from current investors. The capital will most likely be provided in two separate tranches, with the first installment expected in January 2021.

PhonePe’s management noted that the funding round won’t include contributions from new investors.

In addition to becoming an independent business entity, PhonePe will put together a new board of directors, which will include the Fintech firm’s co-founders Sameer Nigam and Rahul Chari, along with professionals from the local Fintech and BFSI (banking, financial services, and insurance) sectors.

As part of Phonepe’s corporate restructuring and business expansion strategy, the firm’s Employee Stock Ownership Plan (Esop) pool has been separated from Flipkart, with all workers being entitled to their share of PhonePe Esops.

Several senior management professionals at PhonePe reportedly received Flipkart stocks as well.

Sameer Nigam, Founder and CEO at PhonePe, remarked:

“Flipkart and PhonePe are already among the more prominent Indian digital platforms with over 250 million users each. This partial spin-off gives PhonePe access to dedicated long-term capital to pursue our vision of providing financial inclusion to a billion Indians.”

PhonePe’s recent plans appear to be consistent with the firm’s intentions of submitting an application for an independent initial public offering (IPO). According to local news outlet LiveMint, PhonePe’s plans to conduct an IPO could materialize by 2023, and the company may be on track to record profits in the next two years.

Kalyan Krishnamurthy, CEO at Flipkart Group, stated:

“As Flipkart Commerce continues to grow strongly serving the needs of Indian customers, we are excited at the future prospects of the group. This move will help PhonePe maximize its potential as it moves to the next phase of its development, and it will also maximize value creation for Flipkart and our shareholders.”