PropTech Investment Corporation II (NASDAQ:PTICU) has completed an initial public offering (IPO) of 23,000,000 units at $10.00 per unit, including 3,000,000 units issued for an over-allotment option. The IPO booked gross proceeds of $230,000,000.

PropTech Investment Corporation II (NASDAQ:PTICU) has completed an initial public offering (IPO) of 23,000,000 units at $10.00 per unit, including 3,000,000 units issued for an over-allotment option. The IPO booked gross proceeds of $230,000,000.

Each unit consists of one share of the company’s Class A common stock and one-third of one redeemable warrant, each whole warrant entitling the holder to purchase one share of Class A common stock at a price of $11.50 per share. Only whole warrants are exercisable and will trade. The shares of Class A common stock and warrants are expected to be listed on Nasdaq under the symbols “PTIC” and “PTICW,” respectively.

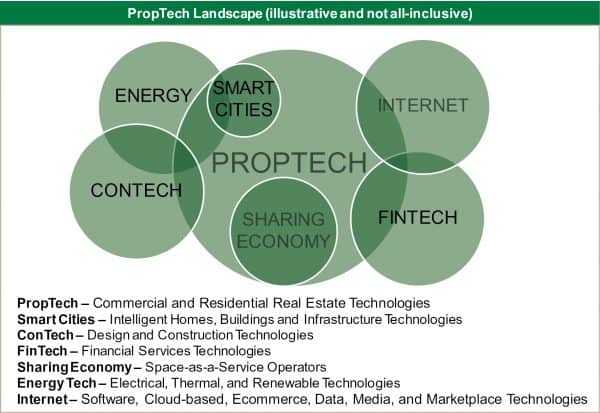

In a filing with the Securities and Exchange Commission, the SPAC explained its strategy:

“PropTech is a relatively nascent technology sector, we believe that a key differentiator in the space will be combining real estate, PropTech, venture capital, and public equity investment expertise with real-time, superior access to the founders and entrepreneurs that are building PropTech companies and the venture capital investors that are funding the growth of these PropTech companies.”

Management will seek to invest in one or more established businesses with an aggregate enterprise value greater than $500 million.

The company is led by co-Chief Executive Officers Thomas D. Hennessy and M. Joseph Beck.

Hennessy served from 2014 to 2019 as a Portfolio Manager of Abu Dhabi Investment Authority, or ADIA, the world’s largest institutional real estate investor. Beck worked at ADIA too from 2012 to 2019 as a Senior Investment Manager. While at ADIA, Beck was responsible for managing office, residential, industrial, and retail assets in the U.S. totaling over $2.7 billion of net asset value.

In a company filing, the company stated that in August 2020, the sponsor purchased Class B founder shares for an aggregate purchase price of $25,000, or approximately $0.005 per share. In December 2020, the company effected a stock dividend of approximately 0.143 shares for each share of Class B common stock outstanding, resulting in the initial stockholders holding an aggregate of 5,750,000 founder shares (an aggregate of 22,143 shares were given back to the sponsor with the number of founder shares issued based on the expectation that founder shares would represent 20% of the outstanding shares upon completion of the offering).

Class B common shares will automatically convert into shares of Class A common stock at the time of the initial business combination on a one-for-one basis, subject to adjustment.

Cantor Fitzgerald & Co. acted as the sole book-running manager for the offering. Northland Capital Markets acted as lead manager.