Fintech has transitioned from the innovation and early development stages of OneConnect’s financial services offering to becoming its catalyst of business growth, according to Ye Wangchun, Chairperson and CEO of OneConnect Financial Technology Co., Ltd. (NYSE: OCFT).

Fintech has transitioned from the innovation and early development stages of OneConnect’s financial services offering to becoming its catalyst of business growth, according to Ye Wangchun, Chairperson and CEO of OneConnect Financial Technology Co., Ltd. (NYSE: OCFT).

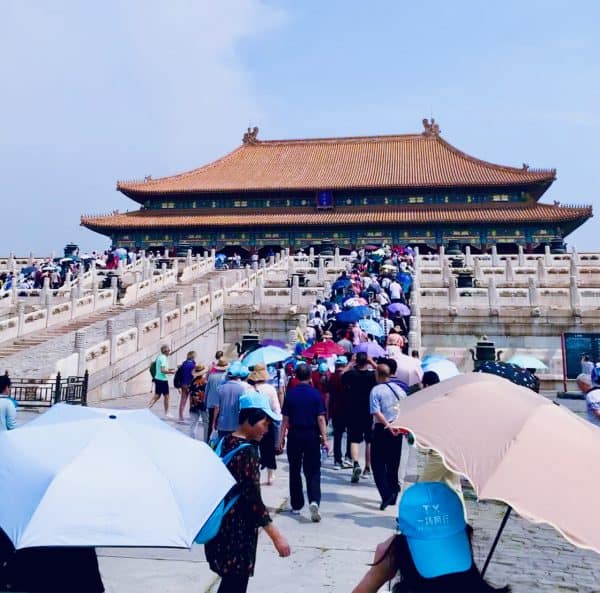

Ye‘s recent comments came during the fourth annual China Digital Banking Forum (organized by OneConnect with assistance from Internet Finance Association of Small and Medium-sized Banks, China Banking Magazine and the Shenzhen Banking Association, under the guidance of the China Banking Association and the Shenzhen Municipal Financial Regulatory Bureau).

Ye noted that it’s now “widely” recognized in the industry that banking institutions should accelerate their digital transformation and Fintech adoption strategies. According to Ye, Fintech has become a “driving force” for small and large banks when it comes to “adapting to the digital economy.” He revealed that the world’s Fintech adoption rate increased from 16% back in 2015 to 64% in 2019, and the rate for China currently stands at around 87% (meaning most banks or organizations are using some type of financial technology platform or service).

The event attracted around 300 industry experts, academics, and media professionals who shared key insights on the digital transformation of banks and how modern technology has become a key driver for them to improve the efficiency of their financial services. As noted in a release, the event has turned into a good opportunity for regulatory officials and agencies, banks and Fintechs to exchange important information and work on different ininiatives.

Fintech adoption and digital or business process transformation is transitioning from “making spare parts to manufacturing the entire vehicle,” Ye stated. The Internet Finance Association of Small and Medium-sized Banks intends to “become the most valuable platform for banks to exchange ideas and cooperate to realize digital transformation” by integrating the resources of its partners into the financial services ecosystem, Ye noted.

OneConnect has helped many financial institutions with updating their technology stack, Ye confirmed. The company is now focused on upgrading its services by integrating various products n order to offer a wider range of solutions for financial institutions, regulators and the government agencies.

As reported recently, OneConnect will be expanding its operations into Malaysian markets. The Fintech firm is notably among the few companies that have acquired a digital banking license from the Hong Kong Monetary Authority. OneConnect is also supporting the BEYOND consortium (in Singapore) as a key technology partner in order to secure a full digital banking license in the city-state.