Biz2Credit announced earlier this week it supports Biden-Harris Administration’s changes to the Paycheck Protection Program (PPP). The company claims that the changes will promote more equitable access to funding for small businesses in need of funding during the COVID-19 pandemic.

Biz2Credit further revealed it has risen to the top of the rankings of PPP providers with 139,559 SBA-approved loans by serving the smallest businesses, especially the self-employed individuals and minority and women-owned businesses, with more than 98% of its approved loan applications coming from businesses with fewer than 20 employees. Rohit Arora, CEO of Biz2Credit, shared his thoughts about the changes by stating:

“The increased access to capital that we are providing for the hardest-hit and underserved small businesses is a clear testament to the importance of digital lending. The fact that we have secured almost twice as many approvals vs. the nation’s two largest banks indicates that a digital platform is the best strategy for serving the broadest range of small business clients, especially for a program as urgently needed as the PPP.”

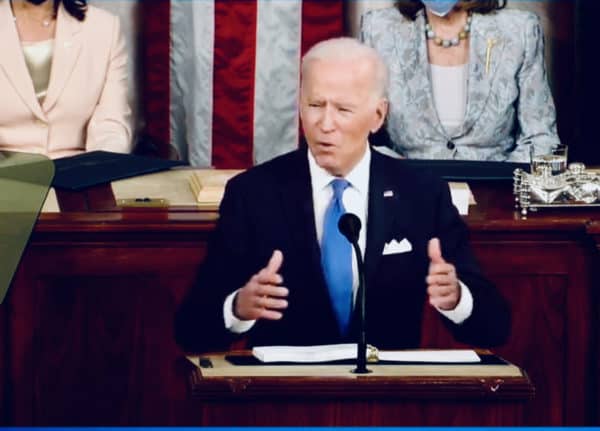

Biz2Credit then noted it is now stating that it supports the Biden-Harris administration’s efforts to increase the flow of capital to these smallest businesses. Specifically, the administration will:

- Institute a 14-day period starting February 24th: During which only companies with fewer than 20 employees can apply for PPP relief. Roughly 98% of small businesses have fewer than 20 employees, and they are Main Street businesses that anchor neighborhoods and create jobs.

- Help sole proprietors, independent contractors, and self-employed individuals receive more financial support: Businesses, such as home repair contractors, beauticians, and small independent retailers, make up a significant majority of all businesses. Among them, companies without employees are 70% owned by women and people of color, yet many have been structurally excluded from the PPP because of how the loans are calculated.

- Eliminate a restriction that prevents small business owners with prior non-fraud felony convictions from obtaining PPP funding: Currently, a business is ineligible if it is at least 20% owned by an individual who has either: (1) an arrest or conviction for a felony related to financial assistance fraud within the previous five years; or (2) any other felony within the previous year. To expand access to PPP, the administration will adopt bipartisan reforms included in the PPP Second Chance Act that would eliminate the second restriction (the one-year look-back) unless the applicant or owner is incarcerated at the time of the application.

- Eliminate an exclusionary restriction that prevents small business owners who are delinquent on their federal student loans from obtaining PPP relief: Currently, the PPP is not available to any business with at least 20% ownership by an individual who is currently delinquent or has defaulted within the last seven years on a federal debt, including a student loan.

- Ensure access for non-citizen small business owners who are lawful U.S. residents by letting them use Individual Taxpayer Identification Numbers (ITINs) to apply for PPP funding: All lawful U.S. residents may access the PPP, but there has been inconsistency in access for ITIN holders, such as Green Card holders or individuals who are in the U.S. on a visa. The SBA will address this by issuing clear guidance in the coming days that otherwise eligible applicants cannot be denied access to the PPP because they use ITINs to pay their taxes.

Since PPP reopened in January, 98% of Biz2Credit’s approvals have gone to firms with fewer than 20 employees. Sole proprietors, independent contractors, and eligible self-employed individuals comprise 72.5% of the approvals. The Biden-Harris administration announced its continuing commitment to enhancing the PPP application process to ensure accountability by:

- Addressing waste, fraud, and abuse across all federal programs: Unlike the previous round of the PPP, loan guaranty approval is now contingent on passing the SBA’s fraud checks, Treasury’s “Do Not Pay” database, and public records. The SBA now also conducts manual loan reviews for the largest loans in the PPP portfolio and a random sampling of other loans.

- Promoting transparency and accountability: The SBA is working to improve the PPP loan application to streamline the process. To encourage self-reporting of demographic data and better illustrate the impact the PPP is making across various population segments, the administration is revamping the application.

- Improving the Emergency Relief Digital Front Door: The SBA is updating key areas of its websites to help more applicants find resources, understand, relief options and complete applications.

- Continuing to conduct extensive stakeholder outreach to learn more about challenges and opportunities in the implementation of current emergency relief programs: The President has spoken with small businesses owners in recent weeks to understand their concerns about relief programs.

- Enhancing the current lender engagement model: The SBA is launching a new initiative to deepen its relationships with lenders. This model will increase the opportunity for lenders to provide recommendations and ask questions about the PPP and drive the resolution of open questions and concerns in a more streamlined way.

Arora then added:

“We continue to encourage collaboration with the teams at SBA and lenders to simplify the application process for business owners and resolve these validation errors that continue to prevent many legitimate borrowers from receiving an SBA approval.”