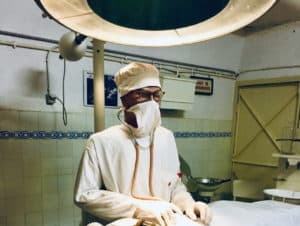

Claire Davidson from banking challenger Branch notes that during the past year, healthcare workers have had to deal with both mental and physical challenges “like none other.” This may have included risking their own lives during the COVID-19 pandemic to mental and emotional stress and exhaustion.

Claire Davidson from banking challenger Branch notes that during the past year, healthcare workers have had to deal with both mental and physical challenges “like none other.” This may have included risking their own lives during the COVID-19 pandemic to mental and emotional stress and exhaustion.

However, Davidson writes in a blog post that when we talk about healthcare workers, it’s important to realize that there are many professionals (not just doctors and nurses) working in this large and diverse industry.

Davidson points out that a hospital or healthcare facility includes other “critical” workers as well. For example, there are long-term care facility staff, X-ray technicians, cooks, custodians, and administrative staff. Davidson also mentioned that the Bureau of Labor Statistics reports that “more people work in hospitals as custodial staff and housekeepers than physicians and surgeons.”

Davidson adds that “the surprising thing is that nearly 20% of these care workers are currently living in poverty—with more than 40% depending on some form of public assistance, as reported by Brookings.”

She further noted that financial stress has been “linked to lowered productivity, reduced ability to problem solve, and more feelings of burnout and exhaustion—which are often linked to medical errors.” She pointed out that it’s critical that we find a way to effectively support these workers—who are all considered essential to “operational success” and “patient care.”

Davidson further explains that this is where earned wage access or EWA comes into the picture.

She continued:

“The two-week pay cycle doesn’t always work for people living paycheck to paycheck—which roughly 78% of hourly workers are. … a surprising number of healthcare workers make up this group. Earned wage access … is a way for employees to access a portion of their earned wages ahead of their scheduled payday.”

Davidson further noted that let’s say you have a healthcare employee named Jake. He knows he makes around $1200 per paycheck. However, after getting his last paycheck—which he has to spend on monthly rent, bills, food, etc—he realizes his car requires some repair.

Jake might not have the cash to take care of the repair—however he’ll be needing his car to drive to work. Before his firm’s EWA program, Jake could have used a payday loan service to get the money for the repairs. This may have caused him to enter “a destructive cycle of high-interest loans to pay off high-interest loans for years,” Davidson added.

She acknowledged that this can be quite stressful. She also mentioned that Jake’s work performance might have been negatively impacted because of this situation. He may end up missing work or may decide to even quit altogether, Davidson noted. She pointed out that Jake may have even been forced to take up a second job if he’s struggling to manage his finances. This could lead to “less sleep, more stress, and poorer job performance at his existing job,” Davidson noted.

However, Jake’s healthcare facility provides EWA. So, instead of having to take out risky, expensive debt, he is able to “instantly access the wages he’s already earned,” Davidson explained.

She added that Jake will now be able to pay for his car repair and keep showing up for his scheduled shifts. And when it’s payday, the wage amount he “accessed in advance is automatically deducted from his paycheck,” Davidson noted. She also mentioned that his financial stress has now been relieved and “he’s more engaged and satisfied at work,” Davidson claims, while adding that it’s “an effective way to turn a potential emergency into a simple, stress-free scenario.”

The Branch team added:

“Pre-pandemic, turnover rates in the healthcare industry were at an all-time high. In fact, the average hospital has turned over 89% of its workforce since 2015, making it the industry with the second-highest turnover rate following the hospitality industry. This matters for several reasons. First, turnover is costly. It’s estimated that it costs as much as two times an employee’s salary to replace them. The better your retention rates, the more money your hospital or healthcare system saves.”

Branch’s blog post further noted:

“Secondly, employee turnover has another cost: It affects productivity, patient care, and treatment outcomes. If you can’t replace or train a new employee in time, your system becomes short-staffed. One study found that higher rates of employee turnover were directly linked to higher patient mortality. “