Goldman Sachs (NYSE:GS) released Q1 earnings results this morning and the prominent investment bank delivered a beat on both top and bottom line.

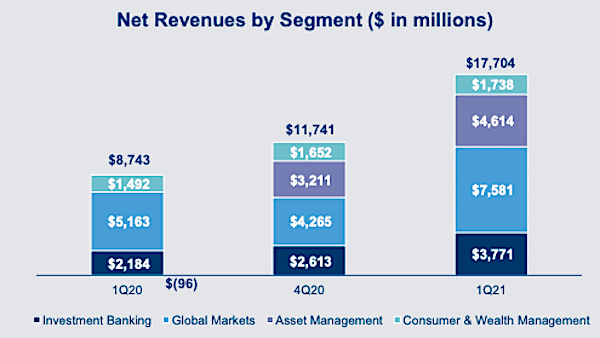

According to the release, Goldman’s revenue came in at $17.7 billion with net earnings at $6.84 billion or EPS of $18.6 during the quarter. Goldman noted that the bank generated record quarterly net revenues and diluted EPS and the highest quarterly ROE since 2009.

Regarding its nascent consumer division that includes the digital bank Marcus, Goldman said it generated record net revenues as well for the consumer and wealth management division.

Goldman was aided by growing consumer confidence in the economy as widespread vaccination should mitigate the ongoing COVID-19 health crisis. The extensive fiscal and monetary stimulus should help the economy – at least in the short run.

Overall, Goldman’s first-quarter 2021 net revenues were significantly higher year over year, reflecting higher net revenues across all segments.

Investment banking generated a 44% increase versus Q4 of 2020 and a 73% increase versus the same quarter last year.

Global markets, including FICC and equities, saw a 78% increase versus Q4 2020 and a 47% increase versus Q1 of 2021.

Consumer and wealth management grew by 5% versus Q4 2020 and 16% in comparison to Q1 of 202o. Consumer banking net revenues reflected higher credit card loan and deposit balances.

In brief, Goldman killed it.

In pre-market trading, shares in Goldman rose by over 1.5%.

The earnings call, which is scheduled for later this morning, should shed more light on expectations for the coming year as well as an update on Goldman’s Fintech efforts.

Update: During the earnings call, Goldman did state that enabling crypto transactions, including a wallet, for retail was not on the near-term list of tasks. Goldman said they are more focused on the institutional side of digital assets. Goldman explained they plan an array of services in their digital bank offering starting with more traditional features. Goldman stated they will continue to monitor the market.

Goldman also commented on the recent reports of exits from the Marcus team. In general, Goldman said they have a deep bench and any attrition this year does not appear to be extraordinary.