Back in October of 2020, the European Union launched a consultation on the possibility of creating a central bank digital currency (CBDC) or digital euro. The results of the consultation will help guide the European Central Bank’s decision as to whether, or not, to launch a formal investigation into the launch of a digital euro.

Back in October of 2020, the European Union launched a consultation on the possibility of creating a central bank digital currency (CBDC) or digital euro. The results of the consultation will help guide the European Central Bank’s decision as to whether, or not, to launch a formal investigation into the launch of a digital euro.

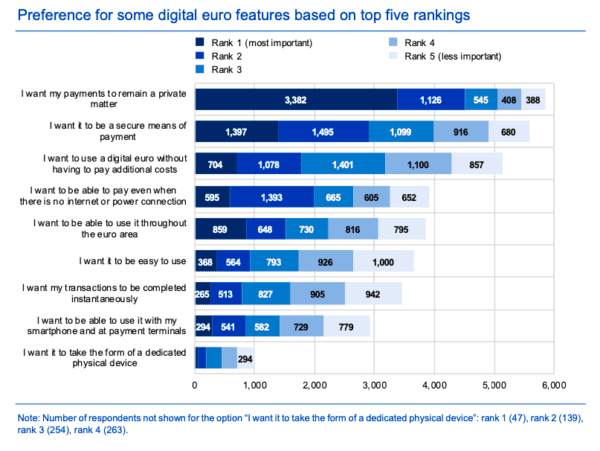

Last week, the results of the consultation were released and more than 8000 individuals responded to the initiative. According to the document, the number one issue in minting a digital euro is privacy – individuals do not want the state to abuse a new form of money. Security was the second most important characteristic of a digital euro, according to respondents.

More specifically:

- What the respondents want most from a digital euro is privacy (43%)

- security (18%)

- usability across the euro area (11%)

- the absence of additional costs (9%)

- offline use (8%)

Of course, policymakers feel a need to balance a demand by the populace for privacy with a requirement to block illicit activity. Crypto assets are frequently the target of allegations of nefarious activity due to its digital nature and a perception that it is difficult to track payments and transfers. A question for respondents on this issue asked “what should be done to ensure an appropriate degree of privacy and protection of personal data in the use of a digital euro, taking into account anti-money laundering requirements, and combating the financing of terrorism and tax evasion?”

According to the document, 2 in 5 respondents thought that “digital euro transactions should be visible to either intermediaries or the central bank, which would effectively allow the application of anti-money laundering and combating the financing of terrorism (AML/CFT) requirements.” Additionally, one out of ten respondents believes that transfers under a certain threshold should remain private.

In conclusion, the report states:

“Although not representative of the European population as a whole, the input received from citizens and professionals signals that privacy, security, usability, low cost and accessibility are among the most popular features that respondents expect from a possible digital euro. Most respondents stress the value of privacy, often acknowledging requirements to avoid illicit activities while protecting the confidentiality of payments data.”

The report is available here.