Global fintech infrastructure platform, Nium, announced on Monday the launch of its maritime payments solution. According to Nium, the solution was created to digitize the payments experience for shipping companies, their management, seafarers, and their families.

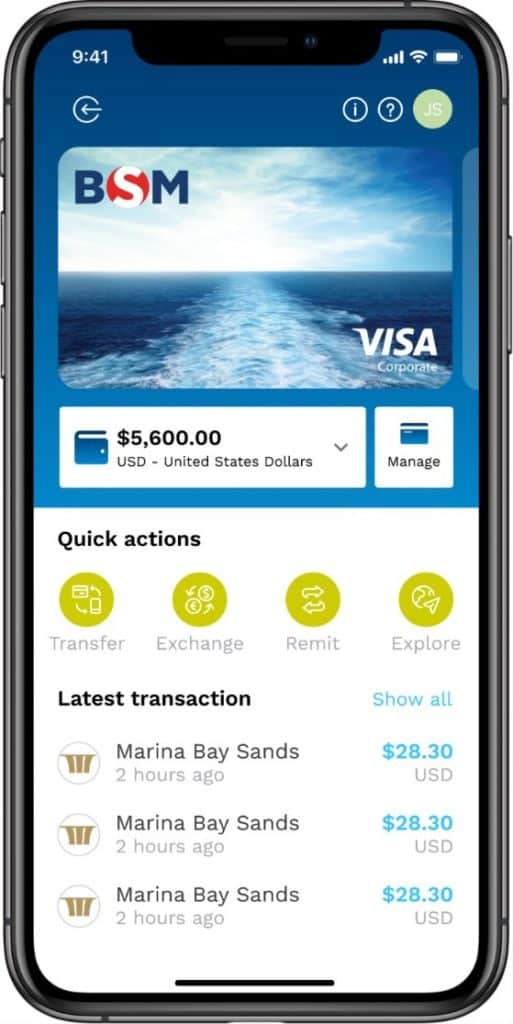

“The Nium maritime payment solution leverages the company’s global licence network and integrated technology stack to enable real-time payroll disbursements, vendor payments, eWallet services, and remittances.”

Nium further reported that the solution combines its “Pay In” and “Pay Out” capabilities, allowing shipping companies to:

- Reduce or even eliminate the use of cash on ships through QR payments

- Launch branded e-wallets with Card Payments, Remittance, Multi-Currency functionality and Travel Insurance services

- Apply exclusive rates for inter and intra company cross-border payments (fund transfers can be done regardless of Internet connectivity

- Comply with payroll and delivery and international banking regulations, including Philippines’ Overseas Employment Administration (POEA) ruling regarding seafarer payments

- Easily track remittance payments

- Send payments in real-time

While sharing more details about the solution, Gitesh Athavale, Head of Sales South East Asia and Hong Kong at Nium, stated:

“Our maritime payments solution provides an efficient and cost-saving way for shipping company management to digitalise payments, including disbursing payroll and making vendor payments. Their seafarers benefit from a convenient and modern way to send and receive money simply or spend it onboard – all through the convenience of one simple app.”

Founded in 2015, Nium (formerly InstaReM) was launched to improve the cross-border payments experience for consumers in the APAC region. It has since expanded and scaled its offerings to meet the needs of SMEs, financial institutions, enterprises, and other payment service providers. Nium added it currently operates its Send, Spend and Receive business in over 100 countries, 65 in real-time.

The company recently joined The Financial Technology Association (FTA). As previously reported, FTA said it believes the successful integration of Fintech solutions in the American financial system starts with the adoption of national policies that recognize the importance of responsible innovation and encompass a coherent vision on key priorities.