As has been widely reported, Marqeta, a top Fintech in the card issuance sector, will go public in an initial public offering (IPO) soon after its registration is approved by the Securities and Exchange Commission (SEC). The initial S-1 was filed on May 14, 2021, and an amended S-1/A was filed earlier today.

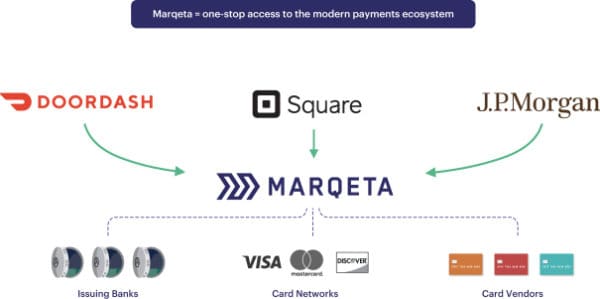

Marqeta works with both early-stage ventures and established firms connecting these businesses with Visa and Mastercard etc. to create a bespoke program that aligns with the goals of the firm leveraging a series of APIs and services. Marqeta works with firms like Uber, Square, Klarna, Doordash and many others – some you probably have heard of and some perhaps not.

Founded in 2009 by CEO Jason Gardner, Marqeta has since “evolved into the world’s first open API modern card issuing platform” operating in 36 different countries with over 320 million cards (including virtual ones) issued. The Marqeta IPO is one of the most anticipated Fintech IPOs of 2021 with a reported valuation ranging from $10 billion to $16 billion. A year ago, Marqeta raised $150 million at a valuation of $4.3 billion. The IPO is expected to raise $100 million and trade on the Nasdaq under ticker symbol “MQ.”

So what can we learn from Marqeta’s S-1 filed with the SEC?

According to the S-1, Marqeta has an annualized revenue of $350 million based on Q4 2020 performance. The company experienced over a 100% growth rate in 2020 with about $60 billion in transactions processed.

To quote the filing on platform revenue:

“We have grown and scaled rapidly in recent periods. Our total net revenue was $143.3 million and $290.3 million for the years ended December 31, 2019, and 2020, respectively, an increase of 103%. For the three months ended March 31, 2020, and 2021, our net revenue was $48.4 million and $108.0 million, respectively, an increase of 123%. We incurred net losses of $58.2 million and $47.7 million for the years ended December 31, 2019, and 2020, respectively, a decrease of 18%. For the three months ended March 31, 2020, and 2021, we incurred net losses of $14.5 million and $12.8 million, respectively, a decrease of 12%.”

Marqeta enables its clients to issue physical, virtual, and tokenized cards. By using Marqeta clients can leverage applications that cover the entire payments lifecycle, including development tools; program administration; and fraud, cases, and chargebacks. The Marqeta platform is described as highly configurable and is able to serve use cases previously unavailable by legacy providers, such as financing at the point-of-sale in the lending industry.

Marqeta sees a global addressable market that will exceed $74 trillion in 2021 or approximately 4 trillion individual payment transactions. As Marqeta processed $60.1 billion (up from $21.7 billion) in 2020, the company holds under 1% of the annual $6.7 trillion of transaction volume conducted through U.S. issuers. So the opportunity could be enormous.

So what are some of the risks as outlined by the company?

Beyond execution risk, competition in the sector exists. To quote the document:

“We face competition along several dimensions, including providers with legacy technology platforms, such as Global Payments (TSYS), Fiserv (First Data), and Fidelity National Information Services; vertical-focused providers, such as Wex and Comdata; and emerging providers, such as Adyen and Stripe. We believe the principal competitive factors in our market include industry expertise, platform and product features and functionality, ability to build new technology and keep pace with innovation, scalability, extensibility, product pricing, security and reliability, brand recognition and reputation, agility, and speed to market. We expect competition to increase in the future as established and emerging companies continue to enter the markets we serve or attempt to address the problems that our Platform addresses. Moreover, as we expand the scope of our Platform, we may face additional competition.”

A key challenge to the firm and something that has been highlighted elsewhere is the fact that Marqeta currently generates 70% of its revenue from a single customer: Square. Obviously, Marqeta would like to have a more diversified revenue channel. Marqeta states:

“For the years ended December 31, 2019, and 2020, Square accounted for 60% and 70% of our net revenue, respectively. For the three months ended March 31, 2020, and 2021, we generated 66% and 73%, respectively, of our net revenue from Square. Although we expect the net revenue from our largest Customer will decrease over time as a percentage of our total net revenue as we generate more net revenue from other Customers, we expect that net revenue from a relatively small group of customers will continue to account for a significant portion of our net revenue in the near term. In the event that any of our largest customers stop using our platform or use our platform in a reduced capacity, our business, results of operations, and financial condition could be adversely affected. In addition, any publicity associated with the loss of any of these customers may adversely affect our reputation and could make it more difficult to attract and retain other customers.”

Marqeta’s agreements with clients do not typically have long-term requirements meaning a change can take place on short notice.

Marqeta’s anticipated use of funds includes working capital and other general corporate purposes and expanding business globally. Marqeta may use some of the proceeds to acquire or invest in complementary businesses, products, services, technologies, or other assets.

In a Dear Investor letter, Gardner states the size of the addressable market is staggering:

In a Dear Investor letter, Gardner states the size of the addressable market is staggering:

“…most of this volume lives on legacy platforms. Additionally, as people migrate away from using cash, there is just that much more volume to be transacted over modern infrastructure. That’s the opportunity and the target: to disrupt legacy platforms and move that volume to a modern platform like Marqeta. We are at the forefront of a significant secular shift towards modern money movement. We believe that transformation will happen over the next decade and that we are still in the early innings. At scale, the winners in this industry will control the vast majority of the volume. Our job is to build the go-to-market platform that winners default to globally. Over time, we intend to broaden our platform by introducing additional capabilities and functionality to meet our customers’ evolving global money movement needs. Our customers need several solutions beyond cards that we’re looking to bring to them in the future. Why? Because we focus relentlessly on our customers.”

While many people may have never heard about Marqeta the company has emerged as a very promising Fintech that is creating the rails necessary to take payments and transfers to the next level. This Fintech IPO is one to watch. The public float should occur in the coming weeks soon after the SEC approves the filing.