Acorns, a neobank serving the consumer market, will go public via a special purpose acquisition company (SPAC) according to a note from the company. The SPAC sector has been red-hot in the past 12 months as it offers a more streamlined process for companies to become a publicly-traded company. The deal is with Pioneer Merger Corp. (NASDAQ:PACX) and will later trade under the ticker “OAKS.”

Acorns, a neobank serving the consumer market, will go public via a special purpose acquisition company (SPAC) according to a note from the company. The SPAC sector has been red-hot in the past 12 months as it offers a more streamlined process for companies to become a publicly-traded company. The deal is with Pioneer Merger Corp. (NASDAQ:PACX) and will later trade under the ticker “OAKS.”

According to Acorns, institutional investors including Wellington Management, TPG, and funds managed by BlackRock and others have committed to an oversubscribed, private placement. Acorns expect to finish with $450 million once the SPAC completes.

Once the de-SPAC takes place, the combined company expects to have an equity value of approximately $2.2 billion, assuming no redemptions.

“I am humbled to represent everyday Americans in the global public markets,” said Noah Kerner, CEO of Acorns. “With the backing of trusted investors including BlackRock, PayPal, NBCUniversal and Comcast Ventures, we are putting the tools of wealth making in everyone’s hands and making it possible for everyday consumers to responsibly manage their money over the long-term. Going public will help elevate our story, introduce many more people to the power of compounding and financial wellness, and bring financial literacy to the mainstream.”

Kerner will continue to run Acorns as CEO once the merger completes.

The transaction is expected to close in the second half of 2021. As part of the merger, Kerner plans to contribute 10% of his personal ownership in Acorns to fund a program giving shares to eligible customers. Pioneer’s sponsor is also planning to give 10% of its ownership in Acorns to this same program.

Jonathan Christodoro, Chairman of Pioneer, stated;

“Acorns is not only a category leader but also a category creator. Its value proposition is built around inclusive, long-term financial wellness. With integrity at its core, the brand has an incredibly loyal following and market leading retention rates. I could not be more excited to partner with Acorns.”

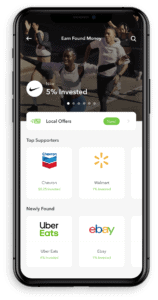

Acorns was created as a subscription-based service that includes investing, education, banking, and earning tools. Acorns reports over 4 million subscribers today and expects to top 10 million by 2025.