On June 15th, the House Financial Services Committee, Task Force on Financial Technology (Fintech) will hold a hearing on central bank digital currency (CBDCs).

On June 15th, the House Financial Services Committee, Task Force on Financial Technology (Fintech) will hold a hearing on central bank digital currency (CBDCs).

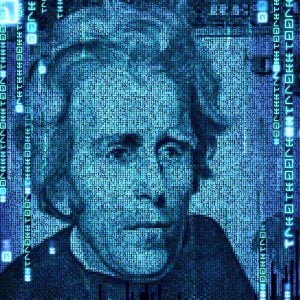

Entitled, Digitizing the Dollar: Investigating the Technological Infrastructure, Privacy, and Financial Inclusion Implications of Central Bank Digital Currencies, the hearing will dive into the emergence of stablecoins and the potential for digital currency issued by central banks.

According to the Committee, the following individuals will testify before the Task Force:

- Carmelle Cadet, Founder and CEO, EMTECH

- Jonathan Dharmapalan, Founder and CEO, eCurrency

- Rohan Grey, Assistant Professor of Law, Willamette University

- Dr. Neha Narula, Director of the Digital Currency Initiative, MIT Media Lab

- Dr. Jenny Gesley, Foreign Law Specialist, Library of Congress

According to the hearing memo, the rise of decentralized cryptocurrencies and private digital currencies has fueled the discussion of CBDCs. To quote the memo:

“Some CBDC proponents have asserted that a payment system that integrates CBDCs would be more efficient, less costly, and allow for faster payments. However, if governments developing CBDCs choose to mimic the technology of private digital currencies, this could result in new payments systems that are structurally very different than how current systems work. Proposals vary to the extent that a CBDC would use existing cryptocurrency technologies in its architecture. One of the key technological decisions to be made for implementing a CBDC is the choice between conventional centralized ledgers, the backbone of the current financial system, or distributed ledger technology (DLT), potentially with vetted validators, often associated with cryptocurrencies. While cryptographic confirmation of transactions on DLT is often touted for its pseudonymity and potential to make systems more efficient and lower costs, a CBDC system where all financial transactions run through a single DLT system may be infeasible. Should the designers of a CBDC opt for a distributed ledger approach, potential climate impact and stress on energy grids should be considered during implementation. Bitcoin, the most widely used cryptocurrency, has been criticized for using “more energy than Argentina.”

The hearing is scheduled to start at 10 AM tomorrow and will be live-streamed on the Committee websites