The Cambridge Centre for Alternative Finance (CCAF) has just released its most recent report providing data on the global alternative finance industry. According to the 2nd Global Alternative Finance Benchmarking Report, this sector of Fintech has grown dramatically – with a caveat: you must exclude the data coming from China.

CCAF defines alternative finance as digital lending and digital capital raising like P2P/marketplace lending as well as investment crowdfunding. Effectively, this sector of Fintech is for online capital formation for both individuals as well as businesses. CCAF also rolls in charity/rewards platforms into the equation.

CCAF is the leading data and research entity covering the global Fintech ecosystem providing much-needed perspective and insight into digital finance. Its benchmarking report is widely referenced and utilized by policymakers around the world to help guide decisions in a highly regulated industry.

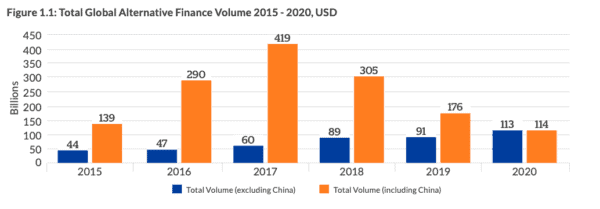

According to the report, China, once the largest alternative finance market in the world, now barely registers having gone to nearly zero. This is due to a regulatory and policy shift away from this sector of Fintech.

As many people know, China dominated the global online alternative finance market up to around 2018. In 2017, China accounted for 86% of the total market largely from peer-to-peer lending platforms that once numbered in the thousands. The rapid rise of these online lenders was joined by profound reports of fraud. The rapid rise was then followed by a bit of a bust as regulators caught up with the booming market. In 2019, the Chinese market accounted for almost half (48%) of the global volume. In 2020, China accounted for a mere 1% of global activity.

CCAF states that if Chinese volumes are included in the analysis, the total global market volume decreased, falling 42% in 2019 and another 35% in 2020. Or from $304.5 billion in 2018 to $176 billion in 2019 and $114 billion in 2020.

When you exclude the Chinese market the story is dramatically different. CCAF reports that the global online alternative finance market has grown consistently over the past three years. Ex-China, alternative finance grew 3% from 2018 to 2019 or $89 billion to $91 billion. And in 2020, despite COVID-19, the global market volume rose a further 24% year-on-year to reach $113 billion.

CCAF says the Chinese experience represents:

“… a cautionary tale about both the importance of regulation in market development, as well as the substantial implications of both excessively permissive and excessively restrictive regimes. And so, we do ourselves a disservice if we do not exclude this behemoth outlier when evaluating the impact of Fintech activities on a global context in the longer term. Therefore, it is important to examine the global online alternative finance market more holistically by taking into account the drastic decline of the Chinese P2P lending market over the last two years.”

Today, the USA and Canada are the largest regions when it comes to alternative finance. In 202o, this region generated almost $74 billion. The UK follows with $12.6 billion followed by Asia Pacific (APAC) at almost $9 billion (not including China).

Globally, the top ten segments as defined by CCAF in 2020 are as follows:

- P2P/Marketplace Consumer Lending

- Balance Sheet Business Lending

- Balance Sheet Consumer Lending

- P2P/Marketplace Business Lending

- P2P/Marketplace Property Lending

- Balance Sheet Property Lending

- Invoice Trading

- Real estate Crowdfunding

- Donation-based Crowdfunding

- Equity-based Crowdfunding

On a per-capita basis, the USA is tops once again followed by the United Kingdom:

- USA

- United Kingdom

- Singapore

- Latvia

- Estonia

- Lithuania

- Finland

- Israel

- Hong Kong SAR

- Slovenia

Debt-based platforms obviously dominate the sector providing a key resource to both consumers and, mostly, smaller businesses – an important aspect of any economy.

CCAF states:

“Small and Medium-sized businesses actively utilise online alternative finance channels and instruments for their funding needs. Since 2015, alternative finance firms have increasingly serviced SME clients, with discussions around SME-focused Fintech activity serving as a key priority for policymakers globally. The utility of alternative finance for SME clients is undeniable; our data suggested that volumes going to entrepreneurs, start-ups and small and medium-sized businesses (SMEs) globally is on the rise and proving to be a viable and long-lasting funding source, which may be even more critical during COVID-19 and its impact on small business operations and cashflows.”

Importantly, there has been a trend in the “institutionalization” of these debt-based platforms as institutions now provide the bulk of the funding. The Benchmarking Report explains:

“2020 firms saw almost an absolute concentration in institutional funders, with over 98% of regional volumes originating from such sources, also representing the highest rate globally. This is mostly a reflection of regulatory conditions favouring accredited investors in debt-financing in North America, as well as conditions of highly developed financial market where retail investors use professional intermediaries more readily. Following is the United Kingdom market, where companies reported a significant growth of institutional funders between 2019 and 2020, leaping significantly from 43% to 66% of funding proportion as well as reaching a volume of approximately $15 billion and $29 billion respectively.”

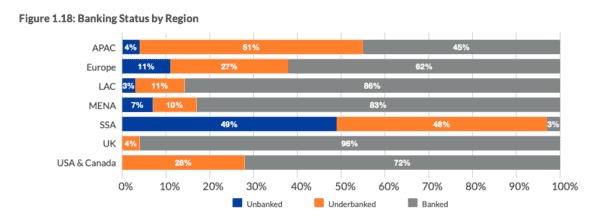

Financial inclusion remains an important thesis when it comes to Fintech and alternative forms of finance. While in developed countries, access to banking and other financial services firms is fairly accessible in less developed regions, Fintech and alternative finance may offer a valuable path to providing financial services to an underserved segment of the population.

The report shows that in a developed market, like the UK, alternative finance primarily caters to already banked customers. But it is important to highlight that progress is being made in boosting access to financial services – even if on an incremental basis. The report states that alternative finance firms across the Asia Pacific region indicated that 51% of their clients were underbanked, with a further 4% unbanked. In Europe, 27% of clients were underbanked and 11% as unbanked.

What about risks for alternative finance?

CCAF shares that platforms worry about regulatory changes where policymakers modify the rules imperiling alternative finance models. The report states:

“… regulation is largely deemed adequate in both the UK and North America (USA and Canada), with perception stable and slightly increasing between 2019 and 2020, reaching 93% and 83% of platforms in each region respectively. On the other hand, the MENA region recorded a stable dissatisfaction with relevant regulation with only 23% and 29% deeming it adequate in 2019 and 2020 respectively. In Europe, 43% and 47% of platforms deemed debt regulation adequate, which may be associated with positive views of the new European Service Provider Regulation overseeing P2P/Marketplace Business and Property Lending, but not P2P/Marketplace Consumer Lending, and hence leaving the latter platforms with often ill-adjusted regulations in the markets where they operate.”

Crowdfund Insider corresponded to one of the main authors of the report Tania Ziegler, Head of Global Benchmarking at the Cambridge Centre for Alternative Finance. Ziegler has authored over 25 CCAF reports and manages the Centre’s industry-facing research activities.

Crowdfund Insider corresponded to one of the main authors of the report Tania Ziegler, Head of Global Benchmarking at the Cambridge Centre for Alternative Finance. Ziegler has authored over 25 CCAF reports and manages the Centre’s industry-facing research activities.

We asked Ziegler about China, a country that went from the lead to almost nothing in regards to digital finance. While it is obvious the about-face in the regulatory approach caused the decline, a broader question – is where did all of this capital demand go without these platforms providing access to capital?

Ziegler said the decline of P2P Lending has certainly left room for other models and iterations of digital lending to arise.

“BigTech examples spring to mind, with BigTech credit having grown substantially since 2019. BigTech firms have been able to provide credit to an array of borrowers, from small businesses accessing supply-chain finance through to customers accessing consumer credit-related to cell-phone purchases or other BNPL models. Though the growth of BigTech credit is a global phenomenon, it is growing quickly and capturing the attention of regulators and policymakers in China in particular.”

The report points to the increase in institutional funding providing capital to digital platforms. In the US, individual investor money has dropped dramatically. We asked Ziegler if she anticipates the same transition will take place in other markets over time?

“Increased participation from institutional investors is not a new trend, but it certainly hastened in certain markets when we look at our 2020 results. While some alternative finance models will always inherently cater well to ‘the crowd’, many of the lending activities observed in our study did attract greater participation from institutions, and this certainly has led to faster scaling,” she explained. “We will likely continue to see institutional partnerships with Fintechs strengthening over the coming months, especially as it relates to the supply of finance. Institutional investors are seeing alternative finance, and in particular digital lending, as a means to diversify their portfolios and to access new or distinct asset classes. As the sector falls under more robust regulation across the globe, this has the potential to reduce risks the sector for such investors and helps to reduce uncertainties about these marketplaces. So it would not surprise us to see greater instances of institutionalisation arise in Latam, the Asia-Pacific, etc as countries within these regions adopt Fintech-forward regulation.”

Ziegler said that an increase in institutionalization doesn’t necessarily mean that retail investors will be ‘crowded out’ per se, as they see growing interest in individual participation, particularly in Asia, parts of Latam, and from within Europe.

“Individual investors are key for the sector, and, especially in markets where digital lending activities are still developing, we will need both types of investor cohorts to fuel and run the market. Anecdotally, it is also worth pointing out that during the pandemic, digital lending platforms that partnered with governments in delivering credit (i.e. CIBLS) faced some restrictions on counter-party risk. In this sense, loan origination could not be linked to retail or individual investors but rather falls under government backed or institutionally backed lending. So in this respect, there are a number of examples where firms which previously catered heavily to Retail investors had to adjust their model in order to participate or take advantage of government schemes as a delivery partner. It will be interesting to see if this continues once such programs are discontinued.”

As the report states that regulatory risk is a big concern for many platforms we asked if these firms need to better manage their interactions with policymakers to facilitate innovation in a highly regulated industry.

Ziegler said that regulation of the Fintech industry is certainly at the forefront of everyone’s mind when thinking about how best to support sector development while maintaining high standards of consumer protection or general market stability. The good news is that their study found that, while ‘changes to regulation’ still factor in as a high risk for Fintech operators, in 2020 more Fintechs in this space noted that they were authorized or licensed within the countries or jurisdictions they operate within.

“We also note that many jurisdictions employed innovation initiatives, such as regulatory sandboxes or innovation offices, which have fostered a more ‘Fintech friendly’ regulatory landscape that supports the development of the industry and promotes greater collaboration and partnerships between Fintechs and traditional players.”

An interesting note shared in the report is there are fewer platforms but a growing number that operate in multiple jurisdictions. So is this a long-term trend? Is this due to consolidation? Or newer models?

“This year’s study found that fewer firms were operating in multiple jurisdictions. To compare, in the 1st Global Alternative Finance Market Benchmark Report, nearly 40% of firms had reported operations in more than one country,” Ziegler said. “This year’s study found that only 17% of our panel had multi-country operations. So, from that perspective, Covid-19 has likely resulted in firms focusing more on their primary or home-markets, rather than on international expansion. The caveat, of course, is that these 17% of firms were responsible for nearly 45% of global volumes, showing that internationalisation is very much alive and well when in absolute terms.”

She explained that firms that have already achieved a certain scale continue to expand into new markets, mainly in regions where internationalization is already common such as Europe and SSA markets. Many factors may influence the long-term development of the alternative finance market, for instance, the European region is characterized by its multilateral agreements over-arching its market; SSA, in contrast, seems to be fertile land for companies from other regions to seize opportunities within the region. With growing ‘Finrech friendly’ ecosystems emerging in the past few years, many are turning their eye from abroad to enter the Kenyan or Nigerian markets, for instance.

As COVID obviously impacted the global economy we inquired as to the impact the health crisis had on the data as well as the frequency of government augmented programs to provide access to capital.

“The impact of COVID was not uniform across all countries/regions. A key question we wished to address through this study was how Covid-19 might impact digital lending and digital capital raising at a national, regional and global level. The story that has emerged is that despite fears that these online activities might contract as a result of the pandemic, the industry at a global level has largely been resilient during 2020,” Ziegler said. “When we compare these findings against that of our Global COVID-19 Fintech Market Rapid Assessment Study, which did find that most Fintech activity verticals grew, an early assessment of Digital Lending activity suggested an annual decline.”

Ziegler noted that transaction values were impacted within the first 6 months of 2020 but, on balance, firms operating within the Digital Lending space had indicated a net-decline when comparing the first half of 2020 against their 2019 experience. However, this initial stagnation demonstrated in the Covid-study is not reflected in the absolute full-year transaction-level data presented here. In fact, most markets have since recovered – with the second half of 2020 making up for the initial market upheaval experienced in the first.

Data collection was impacted as there were some hundred firms that could not participate in the study this year due to operational constraints resultant from the pandemic. In these cases, they saw firms that temporarily or (in some instances) permanently have suspended their activities and shut down.

Simultaneously, there were many examples of firms that, due to their digitally native positioning, were able to weather the storm quite well and even grow substantially. In cases where platforms could partner with the government, they saw impressive growth. Zeigler said that a few obvious examples come to mind:

“In US, governmental support for small businesses, for instance through the provision of the Paycheck Protection Program (PPP) provided much needed liquidity to businesses utilising FinTech solutions, and allowed for several FinTech firms operating a P2P/Marketplace and Balance Sheet Business Lending to originate loans under a US Small Business Administration (SBA) loan. One of the biggest P2P/ Marketplace Business Lending platforms, Funding Circle, became the first platform accredited to the CBILS in the third quarter of 2020. It became the third-largest provider of finance through the scheme, hence, we expect to see the market grow further in 2021. Similarly, the government of Australia introduced the Coronavirus Small and Medium Enterprises (SME) Guarantee scheme to enhance lenders’ willingness and ability to provide a credit line of up to 40-billion Australian dollars to SMEs in loans, which included FinTech lenders as well. The same was noted in Indonesia where a select few FinTechs were used for to support the government’s efforts.”

In regards to the impact of Brexit, an event that was pushed aside as the world focused on the pandemic:

“The UK online alternative finance market has reported consistent annual growth in total market volume, despite disruptions such as Covid-19 pandemic and Brexit. UK digital finance volume recorded 15% increase in 2020 ($12.6 billion) compared to the previous year of 2019 ($11 billion),” said Ziegler. “Additionally, the position of the UK in the global digital finance market has not been impacted by such disruptions, with the United Kingdom positioned in 2nd place in 2020 and accounting for 11% of global market volumes. Therefore, Britain’s role in the global digital finance ecosystem doesn’t seem to be impacted by disruptions.”

Regarding the impact of Brexit on the UK/EU market, Brexit seems to have had an impact on the inflow but not the outflow of the digital finance volume in the UK.

“Total digital finance volume raised by EU firms in the UK saw a significant drop from $55 million in 2019 to $18 million in 2020 (by 66%),” stated Ziegler. “This could be a reflection of heightened uncertainties to foreign firms when trying to position themselves within an uncertain UK future. On the other hand, in 2020, firms headquartered in the UK extended their domestic operations by 20% and operations in the European regions by 27%.”

The report is available below or may be downloaded here.