FT Partners, the leading boutique investment in the Fintech sector, has distributed its own spin on Fintech venture funding. Recently, CI covered CBInsights’ report on Fintech funding, and FT Partners concurs. Fintech is booming during the first half of 2021 fueled in part by the COVID-19 health crisis and the WFH/virtual operation transition.

The report states that after a record Q1 things continued during Q2 on a similar trajectory as the “largest and most active quarter ever for Fintech financing.” During Q2, the report tallies $39 billion in Fintech funding and $44 billion in Mergers and acquisition (M&A) activity.

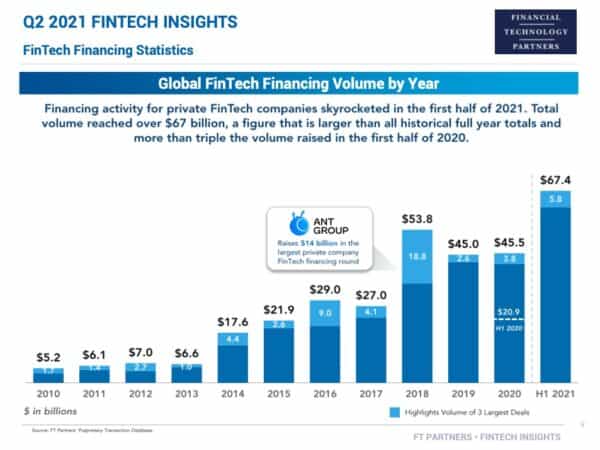

The first half of the year totaled $135.6 billion in M&As and $67.4 billion in Fintech financing.

FT Partners states that during the first 6 months there have been a whopping 185 funding rounds of $100 or more calling VC and strategic investor interest “off the charts.”

The first 6 months have already topped all of 2020 ($45.5 billion) in venture funding and surpassing the previous record of 2018 ($53.8 billion).

Fintech M&A is on track to top the year prior but not quite at the spectacular rate of financing. For the full year of 2020 the report claims $241.2 million in global activity.

North America holds the title of most funding volume claiming 54% of financing with the rest of the world claiming the balance. The breakdown is as follows.

- North America – $37.421 billion

- Europe – $16.3 billion

- Asia – $7.47 billion

- South America- $3.63 billion

By individual country:

- USA – 43% – $34.2 billion

- UK – 10% – $6.4 billion

- India – 3% – $2.13 billion

- Canada – 4% – $2.43 billion

- Germany – 4% – $2.74 billion

There were 23 Fintech IPOs globally in the first half of 2021 with a total of 21 Fintech SPAC transactions announced during the same period.

So what’s next? Is 2021 the pinnacle of Fintechs being funded, M&As, and IPOs? We do not believe so with a caveat. The Fintech market will continue at a robust pace if the wheels do not fall off the global economy – a possibility with the rising rate of inflation and a current US government inclined to spend money faster than they can print it.