Affirm (NASDAQ:AFRM) has announced the securitization of $500 million worth of BNPL loans.

Affirm (NASDAQ:AFRM) has announced the securitization of $500 million worth of BNPL loans.

The transaction is Affirm’s third securitization of 2021, the sixth since it launched its program in July 2020.

According to a release, the offering included five classes of fixed-rate notes: Class A, Class B, Class C, Class D, and Class E, all of which were rated by DBRS-Morningstar, with assigned ratings of AA (sf), A (sf), BBB (sf), BB (sf), and B (sf), respectively.

The notes were placed with a mix of institutional investors in a private offering. By securitizing loans, Affirm can boost lending volume while mitigating portfolio risk. Investors are interested in the higher rates of return in a historically low interest rate environment.

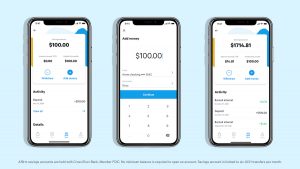

Affirm is a buy now, pay later (BNPL) Fintech that offers credit with installment loans at the point of sale. Technology has enabled BNPLs to emerge as a viable alternative to credit cards. Unlike credit cards and other pay-over-time options, Affirm shows consumers exactly what they will pay up front, and does not increase that amount. Affirm says it will never charge any late or hidden fees.

Michael Linford, Chief Financial Officer at Affirm, issued the following statement:

“Our capital strategy continues to be an important point of competitive differentiation for Affirm as our ABS program builds upon its already strong execution. Our 2021-B securitization was our most efficient execution to date, and provides us with even greater flexibility to support our growth in 2021 and beyond. We appreciate the exceptionally strong investor demand for this offering, and the confidence in our platform from our large, diversified group of institutional capital partners.”