Funding Societies has raised USD $18 million in debt capital led by Helicap Investments, the newly launched Social Impact Debt Fund, and a Japanese financial services group. Helicap Securities acted as sole lead arranger on the secured credit facility.

Funding Societies is based in Singapore and services the broader Southeast Asian market providing access to growth capital for small businesses. Funding Societies states that including the funding received from European impact investors such as Triodos Investment Management for Indonesian business loans, Funding Societies is on track to raise USD $120 million in institutional debt for funding smaller firms.

This funding round also expands the platform’s institutional lender base.

Established in 2015, Funding Societies provides smaller firms with funds provided by both institutional lenders as well as retail investors.

Funding Societies explains that in Southeast Asia, micro, small and medium enterprises (MSMEs) contribute to more than 50% of each ASEAN Member State’s GDP, but because many lack a strong credit track record or collateral, they are frequently rejected for business loans. Funding Societies enables access to finance by using alternative data points including but not limited to the MSME’s cash flow to underwrite these loans.

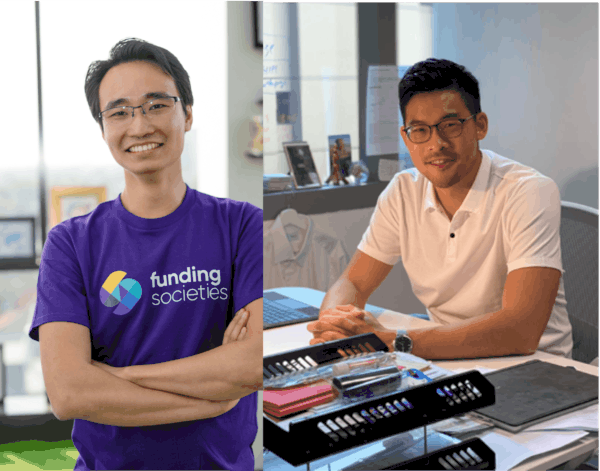

Kelvin Teo, co-founder and Group CEO, Funding Societies | Modalku, said the pandemic has been a test of resilenace and they have successfully navigated the challenge with a solid AI-led credit model:

“We are honored for the faith of Helicap, the Social Impact Debt Fund, and the Japanese financial services group, enabling us to further ride on the growth of SME digital financing. We believe this is a start of a long-term relationship and continuous evolution of Funding Societies.”

David Z. Wang, co-founder and CEO of Helicap Pte. Ltd., the parent company of Helicap Investments and Helicap Securities, said they were pleased to assist Funding Societies in its mission of providing capital to underserved MSMEs:

“Helicap was founded with the aim of breaking down traditional barriers for those who need capital and those who can provide it. This transaction demonstrates the ongoing institutional and individual appetite for private debt investment, and Helicap is well positioned to provide access to quality opportunities through our relationships with leading issuers such as Funding Societies.”

Funding Societies indicated that the USD $18 million facility may increase further with interest from investors across Asia and Europe.