The President’s Working Group on Financial Markets (PWG) has published its report on stablecoins as was anticipated. The report, available here and below, said that if stablecoins are appropriately regulated they could emerge as a more efficient and “more inclusive” payment option. Simultaneously, stablecoins and stablecoin-related activities “present a variety of risks.”

The PWG was joined by the FDIC and the Comptroller of the Currency in constructing the report.

According to the PWG Stablecoin report, these risks include market integrity and investor protection such as “possible fraud and misconduct in digital asset trading, including market manipulation, insider trading, and front running, as well as a lack of trading or price transparency.”

Additionally, stablecoins may pose illicit finance concerns and risks to financial integrity including anti-money laundering (AML) and counter terrorism financing (CFT), alongside prudential concerns such as a run on stablecoin asset when questions may arise regarding redemptions.

The PWG states that digital asset regulations fall under the jurisdiction of the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), and these two agencies “have broad enforcement, rulemaking, and oversight authorities that may address certain of these concerns.” The report states that depending on the structure, stablecoins, or certain parts of stablecoin arrangements, may be securities, commodities, and/or derivatives.

The PWG calls on Congress to create bespoke legislation to “require stablecoin issuers to be insured depository institutions, which are subject to appropriate supervision and regulation, at the depository institution and the holding company level.”

This recommended legislation should “require custodial wallet providers to be subject to appropriate federal oversight.”

Congress should also provide the federal supervisor of a stablecoin issuer with the authority to require any entity that performs activities that are critical to the functioning of the stablecoin arrangement to meet appropriate risk-management standards.

In advance of any legislative action, the PWG states that regulatory agencies are “committed to taking action to address risks falling within each agency’s jurisdiction, including efforts to ensure that stablecoins and related activity comply with existing legal obligations, as well as continued coordination and collaboration on issues of common interest.”

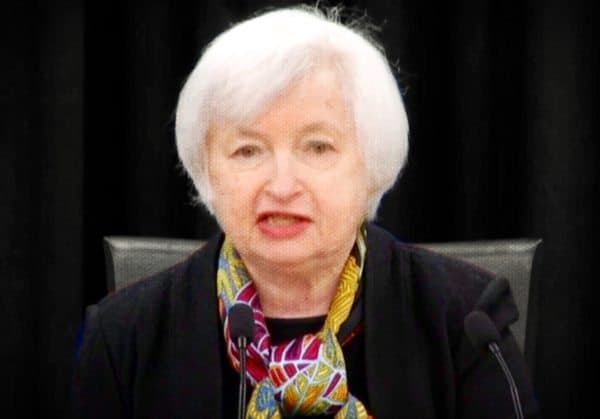

Secretary of the Treasury Janet L. Yellen issued a statement on the report:

Secretary of the Treasury Janet L. Yellen issued a statement on the report:

“Stablecoins that are well-designed and subject to appropriate oversight have the potential to support beneficial payments options. But the absence of appropriate oversight presents risks to users and the broader system. Current oversight is inconsistent and fragmented, with some stablecoins effectively falling outside the regulatory perimeter. Treasury and the agencies involved in this report look forward to working with Members of Congress from both parties on this issue. While Congress considers action, regulators will continue to operate within their mandates to address the risks of these assets.”

Acting Comptroller of the Currency Michael J. Hsu distributed the following comment:

I want to thank Secretary Yellen for the opportunity to work with the PWG and FDIC on the critically important issue of stablecoins. The rapid growth of stablecoins as an innovative and unregulated means to engage in speculative digital asset trading, lending and borrowing is in equal measures awe-inspiring and unsettling. While the salient risks may be mostly trading-related today, tomorrow the risks will be much broader than that and it behooves us as regulators to be strategic in how we approach this and think ahead. I fully support the recommendations in today’s paper. Stablecoins need federal prudential supervision to grow and evolve safely.

The interagency paper identifies the risk of stablecoin runs as the top concern. For the OCC, this hits close to home. The agency was created 158 years ago in response to the instability of the financial system, which was prone to frequent bank runs. There are some interesting similarities between the bank notes of that time and the stablecoins of today. Just as the creation of the OCC helped address the risk of bank runs then, we stand ready to work with our interagency partners to ensure the safe and sound integration of stablecoins into the financial system and mitigate the risk of stablecoin runs today and into the future.

The PWG stablecoin report notes that a review of other digital assets is ongoing in the Administration while stating there is a need to collaborate closely on ways to foster responsible financial innovation.

While the legislative process has a tendency to move rather slowly you may expect both the CFTC and SEC to make independent statements while coordinating any activity. In the absence of Congress crafting legislation, the group may take further action as outlined the document.

The stablecoin market is presently around $127 billion led by Tether (USDT) and Circle’s dollar-based crypto USDC