Klarna, an international retail bank, payments, and shopping service provider, has announced the addition of “Pay Now” to its range of payment options available in the United States.

Klarna, an international retail bank, payments, and shopping service provider, has announced the addition of “Pay Now” to its range of payment options available in the United States.

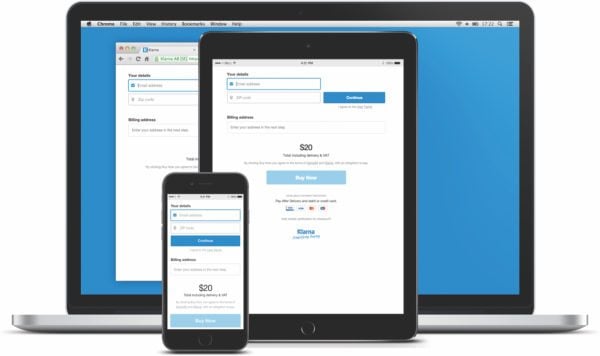

As noted in the update, this payment method should allow clients to make payments immediately and in full at any online or digital retailer where Klarna is offered, with the same seamless and intuitive payment experience whether they decide to pay now or later.

The firm will also be introducing the Klarna Card to the US market, bringing the Fintech firm’s widely-used interest-free Pay in 4 service to a physical card format.

Sebastian Siemiatkowski, Klarna‘s Co-founder and CEO stated:

“Consumers continue to reject double digit interest rates and fee-laden revolving credit, while simultaneously seeking more choice, control and flexibility in how they shop and pay both online and in store. With the introduction of ‘Pay Now’, Klarna now offers US consumers the choice to pay immediately and in full, alongside our sustainable interest-free services. By launching ‘Pay Now’ and introducing the Klarna Card in the US, we are continually developing our services to meet consumers’ changing needs.”

Although Klarna might be best known for its Pay in 4 service in the United States, the company provides an extensive range of payment and shopping services throughout the world.

With the addition of ‘Pay Now,’ Klarna’s US payment and shopping options should be consistent with those provided across the firm’s markets internationally.

When choosing Klarna at a retailers’ checkout, US clients may choose to pay in full immediately with Pay Now, or pay over time with Klarna’s Pay in 4 and Pay in 30 different solutions – without interest.

Meanwhile, retailers can benefit from providing clients with an intuitive checkout experience and giving them more options according to their requirements.

The Klarna Card is an extension of the Klarna app experience, providing US clients the same level of control, convenience and flexibility when carrying out purchases via a physical card as they do using Klarna at a retailers’ checkout or via the Klarna app.

With the Klarna Card, which is established in Europe, clients are able to make payments over time in 4 interest-free payments for in-store or online purchase. The card will reportedly be linked to the Fintech firm’s loyalty program, Vibe, which rewards clients who make payments on time with special deals and discounts.