The French Autorité des Marchés Financiers (AMF) is out with a report that highlights the interest of retail investors in the financial markets. A follow on report to a prior study in April 2020, the AMF states that trading volumes in regulated financial instruments have remained “comparable to its highest level observed in March 2020.”

The AMF says that retail investors have both grown in number and are younger. This is similar to the trend that has occurred in the US as younger investors rushed to platforms like Robinhood and other digital marketplaces to trade securities as well as crypto assets. In the French study, crypto-assets, which are regulated by the AMF, were not included. The AMF indicates that the rise in interest by retail investors was driven, in part, by the ongoing COVID health crisis and affiliated lockdowns and virtual environments.

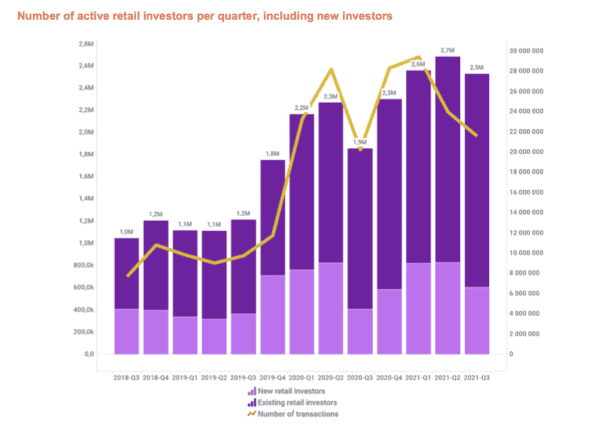

According to the AMF, there has been a “marked increase in active investors.” From around 1 million investors until Q3 2019, the number of active investors has risen to 2.5 million and has remained above this level for the past three quarters. Meanwhile, the average age of these retail investors had declined by 8 years and now is around 36 years old.

The AMF notes that traditionally the sector has been dominated by old school brokers and banks but now trading is done increasingly by “neo-brokers” based outside of France.

“The percentage of transactions per quarter via [neo-brokers] jumped from just under 10% in Q3 2018 to 21.8% in Q3 2021. The active customer base per quarter for neo-brokers has grown 12-fold since Q3 2018 to over 400,000, approaching the active customer base of online brokers.”

The AMF says there is also a growing interest in more complex instruments and smaller-cap firms while trading more frequently.

The neo-brokers referenced are as follows:

- eToro

- De Giro

- Activtrades

- Trade Republic

- Trading 212

The average trade amount at banks and brokers was around €2600 while for neo-brokers this amount was €689 with a median amount of just €61

The AMF does not make a declaration as to whether, or not, the increase in trading activity by younger, retail investors in regulated markets is a beneficial trend. The AMF does state:

“The AMF would need to have an exhaustive view in order to fully exercise its role of protection and education of French retail investors.”