As CI has recently covered, Jacksonville, Florida is an emerging Fintech hub in the US. While Florida has boomed in the past couple of years due to its good governance and business/startup-friendly policies, Jacksonville has managed to attract a good number of financial services firms to set up offices. Jacksonville currently reports over 62,000 Fintech jobs. In 2020, Fintech giant SoFi opened an office in Jacksonville. At that time, SoFi said it anticipated the operation to create 300 new jobs for the region. An example of a smaller firm choosing Jacksonville over other US locations is London-based SmartStream which opened an office in mid-2021. At that time, Aundra Wallace JAXUSA Partnership President stated:

“Talent is the key when companies are making investment decisions and we’re seeing Fintech companies from around the world open here because they know they can find the skilled employees they need to succeed. We thank SmartStream for their investment here and welcome them to the growing list of innovative Fintech companies in Jacksonville.”

Recently, CI connected with Bee (formerly Bee Mortgage), a blockchain-based mortgage lender. The early-stage venture is based in the Jacksonville metropolitan area on the beach at Ponte Vedra.

Also of interest is the fact that Bee raised seed funding via investment crowdfunding platform Wefunder. In 2021, Bee Mortage was backed by 844 individual investors providing over $1.7 million in growth capital.

Tap that app, get a mortgage

Bee pitches its services as the uber for mortgages.

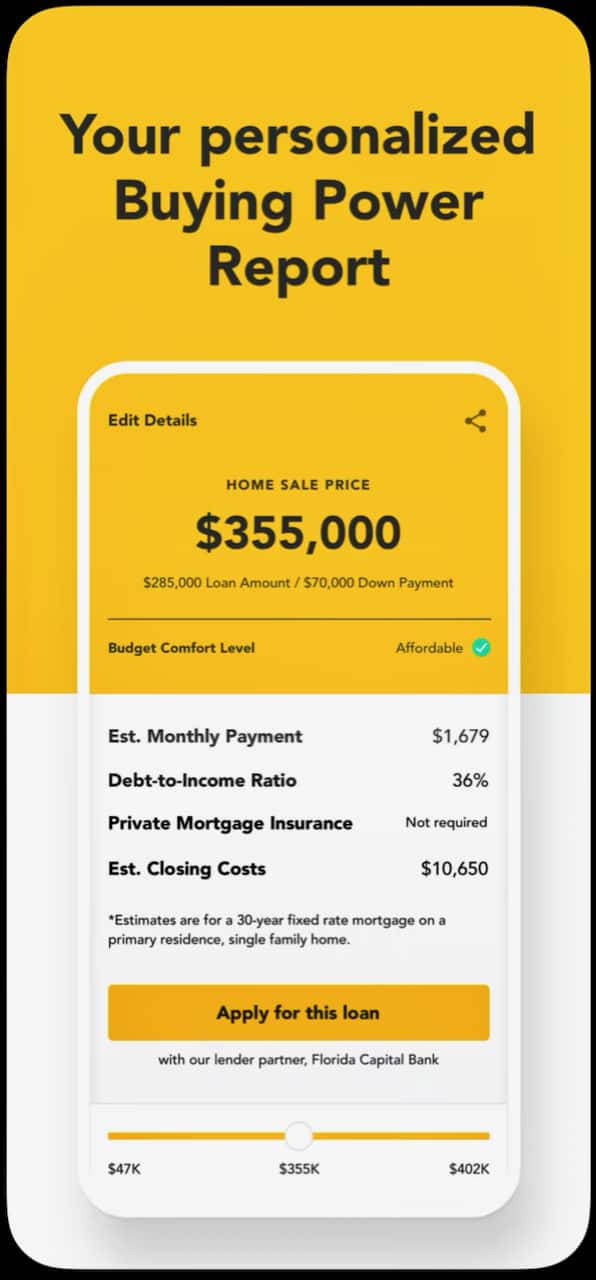

Bee believes that the mortgage industry is “decades behind, failing to meet today’s mobile consumer expectations.” Bee claims that its platform will eliminate the need to deal with a loan officer – largely automating the laborious process. The company states that its blockchain automated service empowers anyone with a smartphone to get a home loan faster and cheaper than with traditional lenders. For real estate agents, Bee promises to assess a buyer’s financial situation making it transparent as to what they can afford.

The app is available on both iOS as well as Android platforms.

CI connected with Bee founder and CEO Curtis Wood to learn more about his firm. Our discussion is shared below.

Bee incorporates blockchain tech to streamline the lending process. How does this work?

Curtis Wood: A smart contract works the same way as a loan officer. It intakes borrower information and renders a decision in response based on set qualifying criteria. The loan officer is the biggest cost for lenders and also the person the borrower interfaces with most.

Curtis Wood: A smart contract works the same way as a loan officer. It intakes borrower information and renders a decision in response based on set qualifying criteria. The loan officer is the biggest cost for lenders and also the person the borrower interfaces with most.

Similar to Robinhood and Uber, Bee’s entire user experience happens in our app with a smart contract processing the loan application instead of a human loan officer. By automating this key task, Bee’s customer acquisition cost is lower and the customer experience is 100% mobile unlike every other lender.

How did you get the idea of leveraging blockchain for lending and which DLT are you using?

Curtis Wood: While working as a mortgage loan officer for a Fortune 100 company, I researched a smart contract and immediately realized it operates the same way a loan officer did by intaking borrower data and returning a decision. I was frequently asked by customers if there was an app to download and use. I had to tell them no because they had to apply with me directly. Our loan origination software with Encompass was not designed to support a mobile mortgage experience.

Can you quantify savings generated for the lending process?

Curtis Wood: We reduced our customer acquisition cost by ⅓ allowing us to offer lower rates than most lenders. Buyers can apply anytime, day or night, even after hours, and still get pre-approved including verified income and assets through Plaid. Buyers and real estate agents in competitive markets will instant access verified pre-approvals.

Do you work with a single bank? Many banks? Do you anticipate holding loans on your book in the future?

Curtis Wood: We’re in private beta right now with one national bank but will be onboarding two others soon. It’s possible we’ll hold some loans on our books if they’re funded via our liquidity pools.

How do you compete in a market where there are many digital lenders?

Curtis Wood: By offering a mobile customer experience that’s done entirely in our app, just like Robinhood, Uber, Fair, Chime, and many others have done for young buyers who do all things in an app.

Digital lending doesn’t equal a mobile experience. There are a lot of digital lenders now but the mortgage market has not been disrupted by mobile. Why is that? 1) because a complete mobile mortgage app user experience hasn’t been offered until now, and 2) the technology to support a complete mobile mortgage hasn’t existed until now with Bee.

Multiple VCs turned you down. Why?

Curtis Wood: Because we didn’t have revenue or a proof of concept yet. Big banks don’t think it can be done (a mobile mortgage app), and are so set in their profit ways that they’ve slammed the door on innovation. So, we’ve built it and are going to kick the door in.

You utilized Wefunder to raise growth capital. How was your experience? Will you do it again for another funding round?

Curtis Wood: After getting rejected by traditional VCs on our first two rounds, we took our idea to the crowd and had immediate success with our Pre-seed and Seed rounds. We oversubscribed our Seed round by $1M as actual consumers know an app for mortgages is a great idea. We’re open to the idea of another crowdfund for our A round.

You are based in the Jacksonville market. How did you end up there? Thoughts on Jacksonville becoming a Fintech hub?

Curtis Wood: We ended up in the Jacksonville area because that’s where we’re from. In addition to Miami and Tampa, Jacksonville is growing fast with lots of local programs supporting small businesses such as JaxBridges which our co-founder and CEO is a graduate of.