Funding Societies, an online capital formation platform serving Asia, has announced $294 million in funding led by SoftBank.

According to a statement by the company, USD $144 million was raised in an oversubscribed Series C+ equity round led by SoftBank Vision Fund 2, with new investors including Vietnamese tech giant VNG Corporation, Rapyd Ventures, Asia-based global investor EDBI, Indies Capital, K3 Ventures, and Ascend Vietnam Ventures. Additionally, FundingSocieties reported that it has received USD$150 million in debt lines from institutional lenders across Europe, the United States, and Asia, some of which have been drawn down since 2021.

Funding Societies raised USD $45 million Series C between 2020 and 2021.

Funding Societies said the capital secures its market-leading position in SouthEast Asia. The company provides financing to SMEs along with a growing portfolio of other services like payments and expense management. Funding Societies accepts both institutional and individual investor commitments.

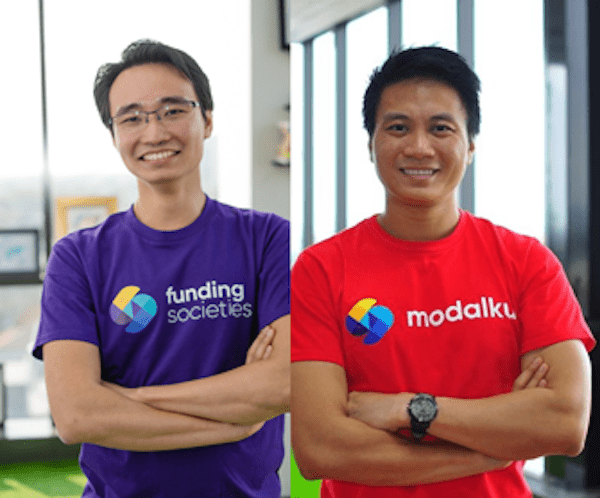

Founded in 2015 by Kelvin Teo and Reynold Wijaya out of Harvard Business School, the company aims to solvs MSMEs’ key pain points for growth, starting with the region’s US$300 billion financing gap.

Even though SMEs make up almost 99% of total enterprises in Southeast Asia, they face many hurdles in obtaining business loans from traditional financial institutions due to a lack of a credit track record or collateral. FundingSocieties offers microloans from USD $500 up to USD $1.5 million, which can be disbursed in as fast as 24 hours.

Funding Societies utilizes an SME financing service with an AI-led credit model and value-added products for under-served businesses. The company claims that its services have contributed USD $3.6 billion in GDP to the region.

The Fintech is now licensed and registered in four countries across the region – Singapore, Indonesia, Malaysia, Thailand, and operating in Vietnam.

To date, it has disbursed over USD $2.1 billion to MSMEs through more than 5 million loan transactions in Southeast Asia.

Teo, co-founder and Group CEO, commented:

“We’re honoured by the faith of our new and existing shareholders. We started Funding Societies | Modalku to empower SMEs by solving their biggest problem, access to financing, especially unsecured financing. A common misconception is that we compete with banks. The reality is we ‘compete’ with savings, friends and families, and personal credit cards. There is a huge unsecured financing gap because it takes patience and focus, or you risk losing a lot of money. Having proven our AI-led credit capabilities in an unprecedented financial crisis, we look to serve SMEs even better with neobanking and deeper regional presence in Southeast Asia.”

Greg Moon, Managing Partner at SoftBank Investment Advisers, said Funding Societies has established a bridge for Southeast Asian SMEs to gain access to sustainable and cheaper financing:

“We are delighted to partner with Kelvin Teo and the team to support their mission to improve societies in Southeast Asia by funding worthy and underserved SMEs.”

Funding Societies’ annualized loan origination is reported to have exceeded USD $1 billion in Q4 2021.

Funding Societies states that it is bringing its operations to more locations in Southeast Asia within the next 12 months.

This latest funding round also provides USD $16 million to former and existing employees via the company’s stock option plan, in the form of share buyback.