Only 6 months after their Series B round, Fintech Branch has announced a $75 million Series C funding round. The company did not disclose the valuation.

The funding was led by Addition with the participation of General Atlantic. Returning investors include Drive Capital, Crosscut Ventures, and Indeed, and more. The company said it would use the funding to pursue new verticals while doubling the headcount – all WFH or remote positions.

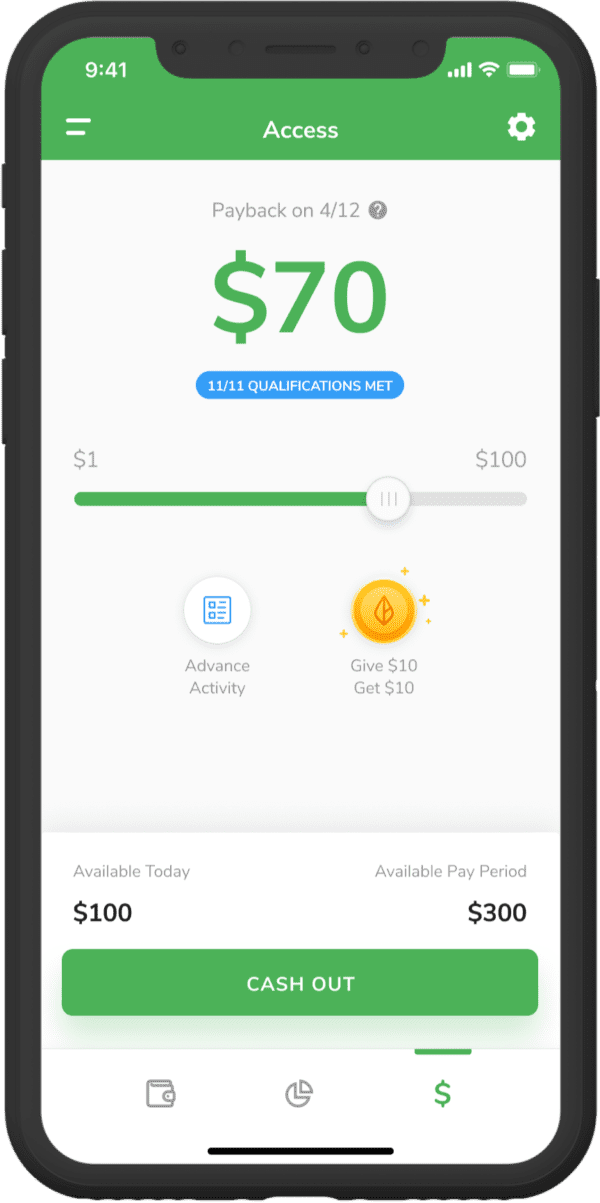

Branch is a company that accelerates payments for companies and has partnered with some big names like Uber Freight, Kelly, Walmart Spark, Flashtract, and Tippy. Branch states that revenue generated by its workforce payments platform grew by more than 700% over the last year. Branch’s offerings include instant, digital payouts of tips, wages, other payments plus free earned wage access, zero-fee banking and a paycard alternative.

Branch CEO Atif Siddiqi said that faster payments is helping working Americans grow financially delivering tremendous value:

“With this new round, we have an incredible opportunity not only to accelerate payments in new sectors, but also provide additional cash flow benefits and tools to our customers.”

Branch added that it is rolling out expense management cards with large enterprise customers including trucking and logistics companies. Branch has also launched the ability to instantly issue a business debit card as well as a new cashback rewards program.

Lee Fixel, founder of Addition, said Branch has proven itself serving some of the country’s largest companies:

“We’re excited to support Atif and the team at Branch as they continue to scale the business and further cement themselves as the market leader in workforce payments.”

In a blog post, Branch said Branch it is proud to “continuously evolve and meet the needs of the American workforce with faster payment solutions and financial wellness tools.”.

By partnering with Branch, companies can automate processes, reduce payroll costs, support workers with free financial services, and significantly decrease logistical burdens and cash flow concerns.