Jack Henry & Associates, Inc. (NASDAQ: JKHY) announced that Bank of Burlington, RockPoint Bank and Moultrie Bank & Trust each have chosen Jack Henry’s tech platform to help them “expand access to financial services in their local communities.”

Tenn.-based RockPoint Bank, Ga.-based Moultrie Bank & Trust, and Vt.-based Bank of Burlington were “formed to serve local communities that had limited access to local financial services due to industry consolidation.”

The banks needed a digitally focused, open, and flexible technology provider “to support rapid growth and help them compete with large banks as well as non-traditional financial institutions.”

With Jack Henry, the banks gain “a strategic and comprehensive technology plan with competitive core solutions and future-ready services such as Banno Digital PlatformTM and LoanVantage.”

It is an opportunity to build a technology strategy “with easy access to a broad ecosystem of Jack Henry solutions and third-party fintechs of choice.”

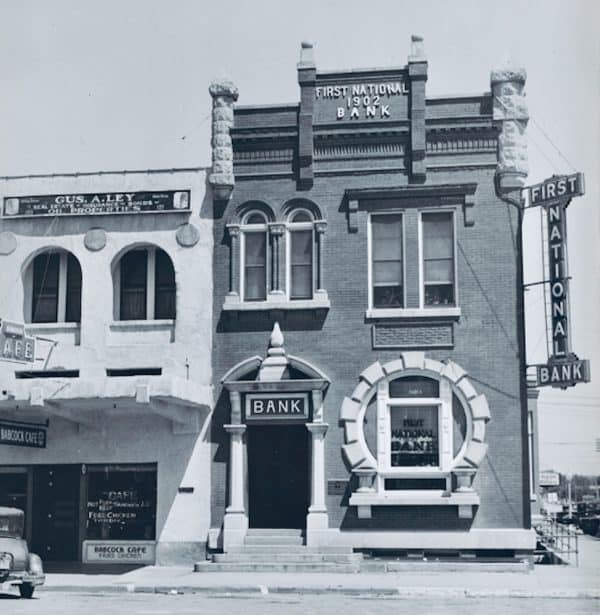

Bank of Burlington is “a commercial bank that was formed to meet the local market needs in Burlington, Vt., where the last locally owned financial institution sold in 2017.”

The firm needed a digital technology provider “with an established ecosystem of leading fintechs and third parties.”

Geoffrey Hesslink, president of Bank of Burlington, stated:

“We had a clear strategy for the fintechs that would fit best into our technology plan and began by asking them which core provider they could best integrate with. Jack Henry was the resounding leader. Jack Henry’s open approach is also our strategy, and it will help us stand out in the market. Personally, I had a great experience working with Jack Henry in my previous role at a larger bank; I was pleased to see that the experience is the same for a de novo institution.”

RockPoint Bank is excited about its growth “since launching in March 2021.”

It surpassed $100 million in assets “in approximately nine months. Hamp Johnston, president and CEO at the bank, commented,”

The bank’s management noted:

“We chose Jack Henry because we needed digital capabilities that would make us stand out and compete directly with regional banks in our market. Their technology allows RockPoint to connect with innovative fintechs that add value to our end users, including Autobooks and faster payment networks. We are confident that Jack Henry will continue enabling our growth with efficiency and ease, preparing us for future trends as we gain market share. Jack Henry is helping RockPoint serve local businesses and professionals in our market and fill the void in the banking landscape caused by bank consolidation.”

Donna Lott, president and CEO at Moultrie Bank & Trust, said:

“Jack Henry offers a full suite of services that meet our technology needs. For instance, their loan lifecycle management solution, LoanVantage, is helping us diversify our loan portfolio, while the Banno Digital Platform offers a supportive and highly competitive digital experience. Jack Henry lifts the burden of technology capabilities, regulations and compliance demands, giving us the flexibility to grow with a focus on our business and community.”

Stacey Zengel, senior vice president of Jack Henry & Associates and president of Jack Henry Banking, said:

“De novos are vital to keeping local banking options alive, which fuels Main Street America. Consolidation in the industry and competition from non-traditional banks are evolving the landscape and blurring the lines between traditional and digital services. We’re here to make sure that these new financial institutions are equipped with the best technology options to meet their business needs – whether that be from Jack Henry or another fintech of their choice. We are providing an ecosystem in which each of these banks can launch and scale with the best technology strategy for their local needs.”

Jack Henry has integrated over 850 Fintechs into its ecosystem and is “the only platform provider with relationships with all four major financial-data aggregators, which helps reduce financial fragmentation for consumers.”