Raisin, a European digital bank and savings Fintech, has distributed a report on the European savings market claiming deposit inflows have “fallen off a cliff” after record increases.

Raisin, a European digital bank and savings Fintech, has distributed a report on the European savings market claiming deposit inflows have “fallen off a cliff” after record increases.

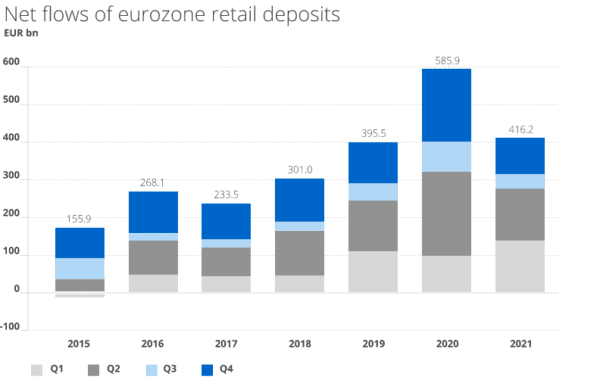

The analysis provided by Raisin indicates that the savers from the eurozone are saving money at a much slower pace. This follows an increase in bank savings of more than half a trillion or €593.7 billion, in 2020 during the height of the COVID-19 health challenge.

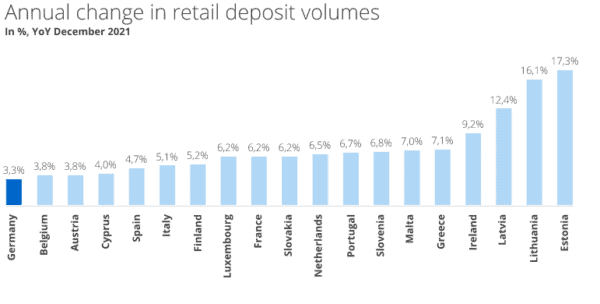

“Nowhere has this been felt more than in Germany, where annual inflows fell below the 100-billion-euro mark for the first time in five years,” says Katharina Lüth, Managing Director at Raisin.

In 2021, deposit inflows in Germany decreased by 43% with annual inflows of almost €84.8 billion, Germans increased their bank balances by nearly the same amount as they did five years ago.

Raisin’s research shows that in 2021, British deposit inflows surpassed £100 billion for the second consecutive year. By the end of the year, inflows for the year exceeded those of both France and Germany, the two biggest deposit markets in Continental Europe.

The only other major market to exhibit the same behavior over the past twelve months has been the Netherlands, where deposit inflows saw a more dramatic decrease (36%), but savers still put twice as much additional funds into their accounts than before COVID.

While Eurozone deposit inflows peaked in the first half of 2021, with savers increasing their bank balances by an extra €274.2 billion, they almost halved in the second half of the year to €135.6 billion. This resulted in inflows for 2021 ending up just ahead of 2019.

“European savers began ramping up their bank balances at the start of the pandemic and continued to save at record rates well into the first half of 2021. Since then, however, deposit inflows in Europe have fallen off a cliff. Nowhere has this been felt more than in Germany, where annual inflows fell below the 100-billion-euro mark for the first time since 2017,” added Lüth.

Lüth explains that savers across Europe are now experiencing high inflation as well as a slowdown of the global economy. With interest rates expected to rise only nominally they predict that Europeans will seek more ways in which they can make their savings work harder for them, “especially as growing socioeconomic uncertainties deter them from investing in risky asset classes.”