LendingClub (NYSE:LC) a digital bank with a focus on providing consumer snd commercial credit, has reported Q1 2022 earnings.

According to the Fintech, revenue was reported at $289.5 million growing 174% year-over-year. Loan originations grew by 117%. Net income came in at $40.8 million compared to a $47.1 million loss during Q1 2021. Net income also rose by 40% sequentially in contrast to Q4 2021. EPS was $0.39.

LendingClub CEO Scott Sanborn issued the following comment on reported results:

“We grew our member base beyond four million to serve more everyday Americans who are looking to refinance out of higher-cost credit card debt, save more of what they earn and find a better way to bank. With another quarter of record results, we are clearly demonstrating the power of our loyal customers, significant data advantage and differentiated marketplace bank model. We believe we are well-positioned to execute on our strategy and outperform the competition while helping our members effectively navigate the ever-changing economic landscape.”

Customer deposits of $4 billion were up 27% from December 31, 2021, and 68% from March 31, 2021 providing more fire power to fund loans. LendingClubsaid that marketplace revenue of $180.0 million grew 6% sequentially and 120% year-over-year, showing solid growth in marketplace loan originations as well as good investor demand.

LendingClub provided the following guidance for Q2 2022 as well as the full-year expectations.

Total revenue for Q2 is predicted to be around $295 to $305 million or a net income of approximately $40 to $45 million.

For the year, revenue is anticipated to be between $1.15 billion to $1.25 billion and earnings of $145 to $150 million.

Shares rose higher in after-hours trading as investors welcomed the strong Q1 results as well as the encouraging guidance – especially in a challenging economic period.

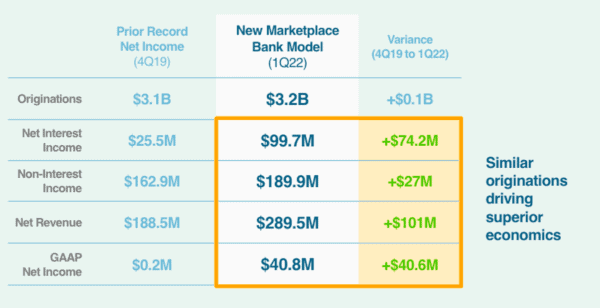

Update: During the earnings call, it was noted that a comparison between the old model and the new model showed loan originations holding about the same yet there has been a dramatic increase in net revenue and net income with the new model. This is due to LendingClub pursuing a more traditional banking model. Using low-cost capital (Deposits) to fund loans and holding some of those loans on their balance sheet. By holding some loans, as opposed to selling them to investors, LendingClub keeps that revenue generated by the interest. In fact, a loan held is generating 3X more than a sold loan – over time. LendingClub said it intends to retain 20% to 25% of loans for the remainder of the year but this amount could move higher. LendingClub shares are trading about 20% higher in after-hours but shares remain far below their 52-week high.