Goldman Sachs (NYSE:GS) has filed an 8-K with the Securities and Exchange Commission that describes the new divisional structure of the firm that was revealed last year.

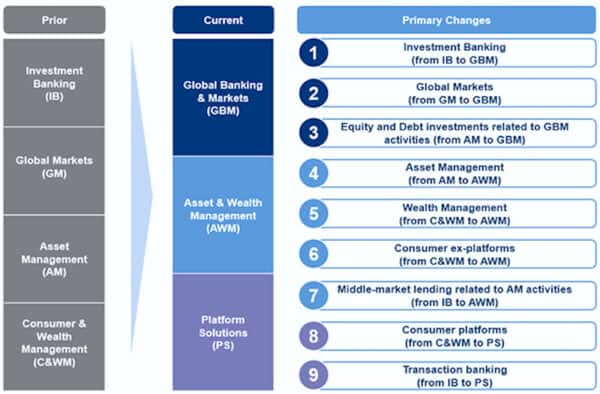

Last October, Goldman outlined its new reporting structure, which included the following:

- Asset and Wealth Management

- Global Banking and Markets

- Platform Solutions

Global Banking and Markets include the more traditional investment banking operations along with FICC [Fixed Income Currency and Commodities] etc.

Asset and Wealth Management is a new segment that includes the results previously reported in Asset Management and Wealth Management (previously included in Consumer & Wealth Management), and additionally includes the results from the firm’s direct-to-consumer banking business and more.

Platform Solutions is another new segment that includes the results from credit card partnerships (think Apple Card), point-of-sale financing, and the firm’s transaction banking business, previously reported in Investment Banking. Consumer platforms, part of platform solutions, include partnerships offering credit cards and point-of-sale financing.

Marcus, the consumer banking brand, has been slotted into the Asset and Wealth Management Division.

According to the filing, Platform Solutions has lost $1.2 billion during the first nine months of 2022. The provision for credit losses for the same period was $942 million.

Regarding Marcus, Goldman did not provide sufficient detail to understand how it is doing as a standalone digital bank – but this should be disclosed in the earnings call next week. The pre-tax earnings of Asset and Wealth Management stand at a positive $1.289 billion.

WSJ.com reported that Goldman’s push to offer checking by Marcus has been sidelined for now, along with the decision to exit personal loans.

Goldman recently announced it was cutting staff at the bank of around 3000 employees, reflecting the challenging economic environment that is poised to get worse.

Goldman will be announcing Q4 and full-year 2022 earnings on January 17, 2023 at 730AM. A conference call to discuss the financial results will be held at 9:30 AM ET. Members of the public who would like to listen to the conference call should dial +1-888-205-6786 or you may access the call via the Investor Relations section of Goldman’s website, www.goldmansachs.com/investor-relations