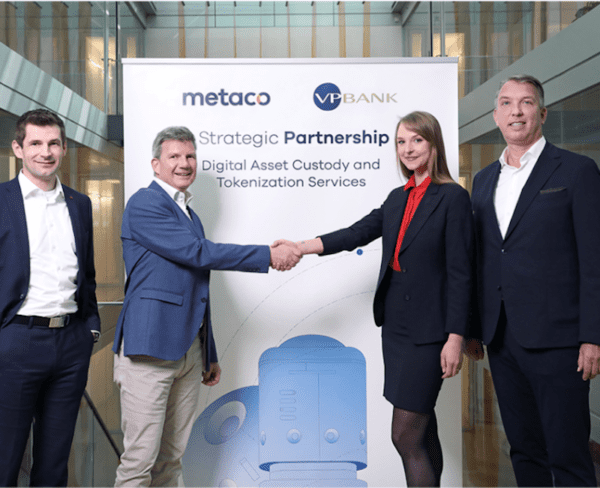

Metaco has revealed a partnership with Liechtenstein private bank VP Bank (SWX: VPBN). According to a statement distributed by Metaco, the bank will incorporate Metaco’s Harmonize platform to enable digital asset custody and tokenization services, including financial assets, minting, burning, and storage of tokens.

VP Bank is said to be one of the largest private banks in Liechtenstein with locations in various financial centers such as Europe, BVI and Asia. VP Bank reports over CHF 46 billion assets under management at the end of catering to private clients and HNWIs.

VP Bank’s digital asset strategy initially sought the tokenization and custody of collectible physical assets like collectibles such as paintings, watches and sculptures etc. VP Bank will now be able to pursue new opportunities when issuing, holding and managing digital assets on behalf of its clients.

Metaco’s Harmonize product is a managed service, fully integrated into the bank’s core banking system.

Chief Product Officer at VP Bank Marcel Fleisch said they are committed to rethinking wealth management by combining traditional banking with digital ecosystems. He described the partnership as a “major step towards building VP Bank’s foundation of the future.”

Metaco was founded in Switzerland in 2015 with a mission to enable financial and non-financial institutions to securely build their digital asset operations.

VP Bank has been around since 1956 and specializes in the development of customised financial solutions for intermediaries and private persons.