The slump in new initial public offerings IPOs for US-based SPACs (special-purpose acquisition companies) has stretched into the first quarter of 2023, according to a report by S&P Global Market Intelligence.

Even though SPACs or blank check firms, have been around for decades, the method of taking a firm public boomed for awhile, peaking during Q1 of 2021 when 278 firms went public via SPACs representing $278 billion in aggregate value. Things began to slow following the scrutiny of regulators followed by the flagging economy.

S&P reports:

“Only eight blank-check companies went public in the first quarter, a drop from nine in the preceding quarter and 44 in the first quarter of 2022, according to the latest S&P Global Market Intelligence data and analysis. The latest batch of SPAC IPOs raised just $709.0 million, a nearly 92% drop from the $8.59 billion raised in the same period in 2022.”

The report shares that broader M&A activity is showing some signs of life after a slowdown in 2022.

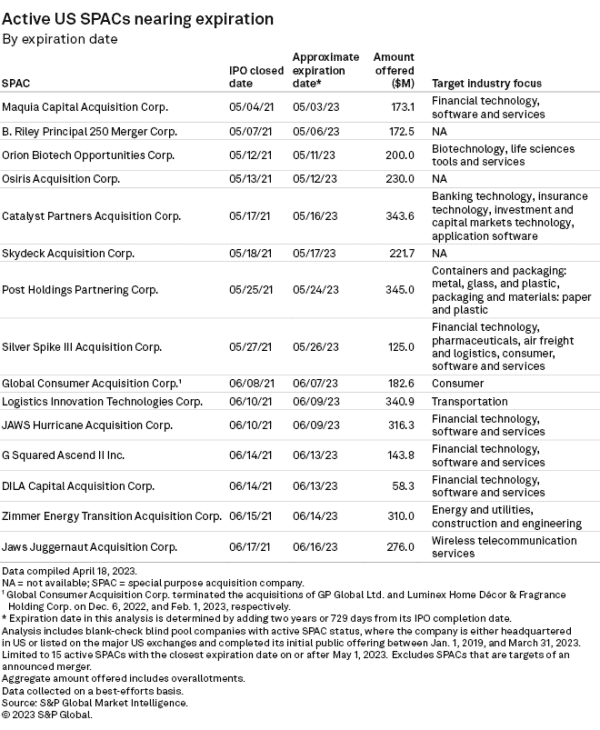

A recent count of 15 SPACs nearing their expirations included those targeting deals in Fintech, software, healthcare, and consumer spaces. The value of those offerings ranged from the $58.3 million offered by DILA Capital Acquisition Corp. to $345.0 million from Post Holdings Partnering Corp.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!