Upgrade has made its first acquisition by purchasing Uplift for $100 million in both cash and stock, according to a company statement.

Uplift is a buy now pay later (BNPL) provider focusing on the travel sector. Upgrade is a neobank that provides a growing number of financial services, starting with online lending and cards aiming to support “affordable and responsible credit.” Upgrade’s saving product currently offers a 4.81% interest rate – one of the highest on the market.

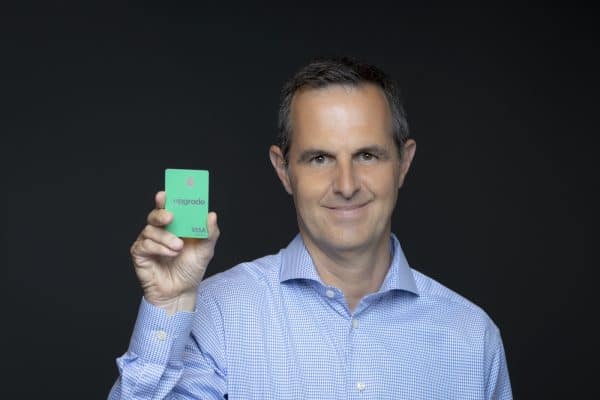

Upgrade was founded by CEO Renaud Laplanche, the founder of LendingClub, which started as an online lender and now is a chartered digital bank.

Upgrade was founded by CEO Renaud Laplanche, the founder of LendingClub, which started as an online lender and now is a chartered digital bank.

Uplift currently reports 3.3 million customers in coordination with 300 travel firms like airlines, cruise lines, and hotels in both the US and Canada. Uplifts BNPL starts with 0% financing while coordinating with credit reporting to help users maintain a good credit score.

Laplanche said they are “thrilled” to bring Uplift’s team and partners to Upgrade.

“The Uplift team has established the company as the leading BNPL provider in the travel industry, and we look forward to combining forces to make travel more accessible and affordable for millions of consumers, and over time implement similar solutions in adjacent parts of our customers’ lives.”

Tom Botts, Chief Commercial Officer at Uplift, predicted that acquisition will accelerate their ability to grow and service more users.

“As part of Upgrade, more resources will be available to better serve our partners and customers to continue to develop simple, surprise-free, and straightforward payment plans to ensure people can pay for the things that matter most, the ones that elevate their lives.”

Upgrade reports having provided more than $24 billion in credit since its launch in 2017 from over 2 million customers. The acquisition of Uplift makes a lot of sense as the BNPL market has become more crowded and consumers may be more interested in working with a platform that can provide additional financial services.