CI has reported on the moribund activity for venture capital and private equity for some time now. Again and again, we receive reports that VC and PE cratered in 2023.

Today, once again, S&P Global Market Intelligence has shared another gloomy report stating that global private equity and VC deal value and volume in 2023 were at their lowest in at least five years.

According to S&P, transaction value cratered by 34.7% year over year to $474.14 billion, and deal count fell to 12,016 from 17,549.

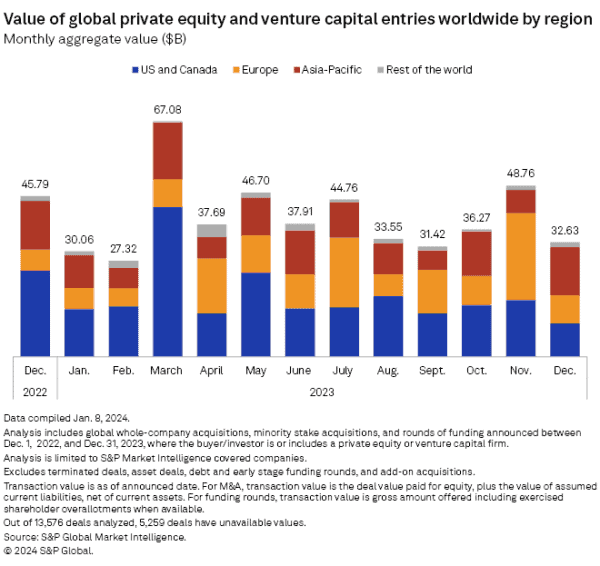

During the month of December 2023, deal value and volume recorded year-over-year declines. Deal value stood at $32.63 billion for the month, down from $45.79 billion year over year. The number of deals dropped to 802 from 1,560 in December 2022.

When looking at Q4, year-over-year numbers sank as well.

Transaction value fell to $117.66 billion from $136.87 billion when compared to Q4 2022, and the number of deals dropped to 2,761 from 4,006.

Asia Pacific generated the most activity at $13.80 billion, down slightly from $13.84 billion in the year-ago period, with USA/Canada following at $9.55 billion, a 61.1% decline from $24.58 billion in December of 2022.

Interestingly, Europe experienced an increase in December 2024, going to $7.94 billion from $6 billion in December 2022.

What the report does not provide is expectations for 2024. Some prognosticators predict a bounce in 2024 as interest rates start to head in the other direction. Of course, there are a lot of moving parts in the equation, including global strife in the Gulf, Ukraine, and warmongering China, which is lining up for a fight over Taiwan.