One strategy to protect yourself against inflation in the future is to put your money in places where its future value is linked to inflation. It is in this context that renewable energy investments offer an attractive proposition.

One strategy to protect yourself against inflation in the future is to put your money in places where its future value is linked to inflation. It is in this context that renewable energy investments offer an attractive proposition.

In the UK, renewable energy projects receive some or all of their income through Government backed schemes. For smaller projects, such as a single large wind turbine, this is the Feed-in-Tariff, which provides a fixed and guaranteed income stream for each quantity of electricity produced. Crucially, this income stream is linked to inflation.

In other words if inflation goes up, then so do revenues. And all other things being equal, so do investor returns too.

The preceding text is from a blog post published to Abundance Generation’s web site in April of last year. This approach has finally come to fruition in the form of the first inflation-linked deal on Abundance Generation, BNRG Gorse.

The preceding text is from a blog post published to Abundance Generation’s web site in April of last year. This approach has finally come to fruition in the form of the first inflation-linked deal on Abundance Generation, BNRG Gorse.

Assuming inflation (based on the Retail Price Index) of 2.8% over the life of the project, the project is expected to provide gross returns of 7.35% including a 0.15% “pioneer bonus” in recognition of this first-of-its-kind offering.

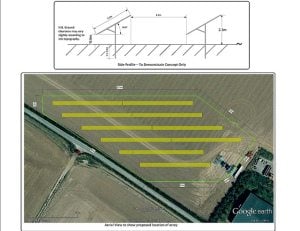

The BNRG Gorse project seeks to raise £730,000 to install two 249kW solar arrays. Both sites in Kent have planning permission and according to the offering page construction has already begun. The project has the option to increase the size to £1.13 million if a further site with similar characteristics is included.

This is BNRG’s second offering on Abundance. The first closed earlier in 2013 after raising the full amount of £385,000. Those interested in seeing how the first crowdfunded installation by BNRG is performing can see energy totals here.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!