David Weild, former Vice Chair of Nasdaq and current CEO of IssuWorks, delivered a presentation to the SEC Advisory Committee on Small and Emerging Companies that addressed the issue of venture exchanges. The need for a venture exchange has recently percolated up in discussion as new types of securities are being created that may require a secondary market to create liquidity for buyers and sellers.

David Weild, former Vice Chair of Nasdaq and current CEO of IssuWorks, delivered a presentation to the SEC Advisory Committee on Small and Emerging Companies that addressed the issue of venture exchanges. The need for a venture exchange has recently percolated up in discussion as new types of securities are being created that may require a secondary market to create liquidity for buyers and sellers.

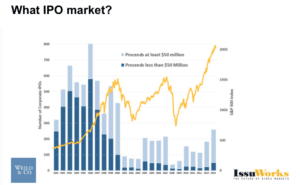

Weild believes that IPOs are in the ICU and the data supports his assertion. IPOs have been in decline for years now as fewer companies decide to remain public to avoid the burdensome cost and associated requirements with a public listing. Weild states that in domestically since 1998;

- US fell from #1 to 12th place for small IPOs

- For large IPOs the US dropped from first to 2nd place

- The number of listed companies has declined from 9,000 to approximately 5000 (and we should be at 13,000 listed companies today)

- The trend in IPOs remains concerning and in decline

- The US should be doing 950 IPOs a year

And why should people be concerned? Access to capital for smaller companies means more jobs and better economic growth for all.

The existing ecosystem works ok for large companies but not so much for smalls. The cost to issuers is high. A “one size fits all” approach has dimmed the market incentives for firms to participate in smaller cap issues. This is where Venture Exchanges fit.

The existing ecosystem works ok for large companies but not so much for smalls. The cost to issuers is high. A “one size fits all” approach has dimmed the market incentives for firms to participate in smaller cap issues. This is where Venture Exchanges fit.

Weild is of the opinion that we should “manage by objective” to achieve our goals of a robust and liquid market for smaller cap companies. These issuers should be subjected to a lighter touch regulatory approach that recognizes a need for scaled disclosure to fuel a pro-growth environment. He also questions the propriety of for profit exchanges to act as efficient and incentivized exchanges noting their goals are aligned with shareholders and not with issuers.

In brief, Weild believes we should “Be Bold. Institutionalize the solution”. And that currently, “the cure is worse than the disease”. He ascknowledges the risk stating, “Yes there will be failures and yes people will lose money. But you want to give people a shot at grabbing that brass ring and become a public company”.

[scribd id=257684546 key=key-zXva6LL37ndAEfSQesDR mode=scroll]