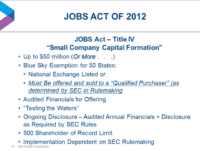

Fixing the JOBS Act Beyond JOBS Act 3.0: Follow the Money

Often repeated, but not always followed, is the advice: follow the money. Sometimes basic problems – and their solutions – are more readily understood (and solved) with this simple mantra. Effective capital markets are no exception. They demand faithful adherence to this principle. Lose… Read More

Read more in: Featured Headlines, Opinion, Politics, Legal & Regulation | Tagged david weild, jobs act, jobs act 3.0, mark elenowitz, perspective, regulation a, regulation cf, sam guzik, sec, securities and exchange commission, tripoint global, venture exchanges