While much of the media and industry insiders continue to pound the table on new forms of finance such as crowdfunding the vast majority of small businesses remain unaware of new options. Most likely these smalls are way too busy running their firms and paying bills to learn about peer to peer lending and other options.

While much of the media and industry insiders continue to pound the table on new forms of finance such as crowdfunding the vast majority of small businesses remain unaware of new options. Most likely these smalls are way too busy running their firms and paying bills to learn about peer to peer lending and other options.

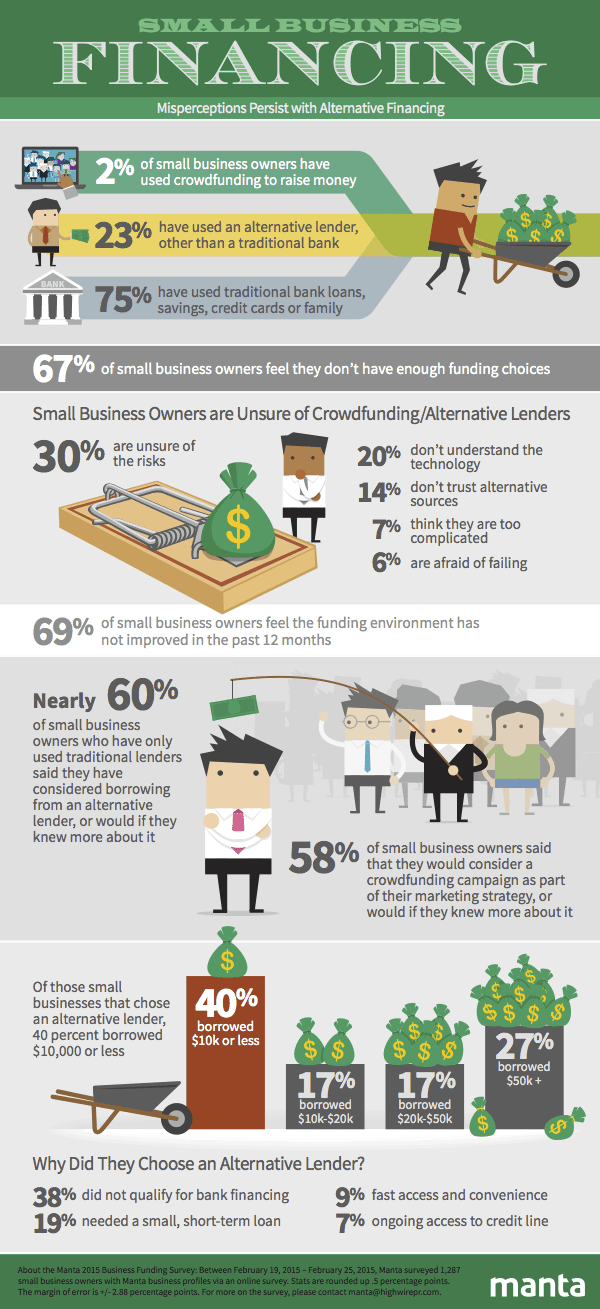

According to data from Manta, an online SME directory and business resource platform, 2/3 of SME owners do not think there are enough funding options available and 69% believe the status quo persists without improvement during the past 12 months. These numbers are indicative of an information gap between businesses in need of capital and opportunities to raise capital. Manta conducted an online survey last month polling 1287 small business owners.

Manta states, “the majority of small business owners who have obtained traditional loans note uncertainty regarding crowdfunding and alternative lending options. Thirty percent of respondents are unsure of the risks, another 20 percent don’t understand the technology associated with these alternative sources and 14 percent report they simply do not trust them. A small number believe crowdfunding sites and alternative lenders are too complicated, while others fear business failure with less traditional financing methods (seven percent and six percent, respectively).”

The majority (over 70%) still use the old method of savings, credit cards and the occasional bank loan.

“Small business owners have more diverse options today than ever before when it comes to funding their business,” said John Swanciger, CEO, Manta. “However, we’re seeing a gap between what’s available and the perception among small businesses that the lending environment has not improved. Even though traditional bank loans are difficult to secure, small businesses are still apt to rely on them.”

For the business owners that took the alternative route, 38 percent did so because they did not qualify for traditional bank financing. Nearly 20 percent sought alternative lending because they needed a small short-term loan, while nine percent recognized the fast access and convenience associated with alternative lending options, and seven percent wanted ongoing access to a credit line.

Their survey results also showed that when small business owners received alternative financing, the amounts they borrowed varied greatly. Most (40%) borrowed $10,000 or less. Others aimed higher, with 27 percent borrowing $50,000 or more. Remaining respondents were split—17 percent borrowed $10,000 – $20,000 and another 17 percent borrowed $20,000 – $50,000.