CircleUp, an investment crowdfunding platform that targets early stage consumer product companies, has launched its second Marketplace Index Fund II. The first Fund recently closed after raising $4.4 million. There is a $25,000 minimum for investors.

CircleUp, an investment crowdfunding platform that targets early stage consumer product companies, has launched its second Marketplace Index Fund II. The first Fund recently closed after raising $4.4 million. There is a $25,000 minimum for investors.

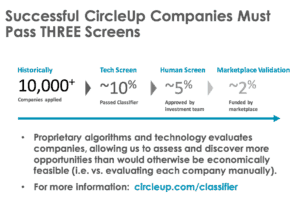

The concept of the fund is pretty simple. Participation means your money goes into a basket of 25 plus early stage companies thus you get immediate diversification as opposed to concentrated risk. Companies applying to the CircleUp platform to raise capital must go through several layers of validation before they are accepted on the platform. CircleUp claims revenue growth of 80% for consumer companies funded on CircleUp. The structure is for preferred equity in companies and/or convertible notes.  Expectations are for each company to receive an investment of $100,000 and up. The Fund will have an 8-year life with the possibility of extensions at the end of the term. CircleUp takes a 0.5% management fee but no carry.

Expectations are for each company to receive an investment of $100,000 and up. The Fund will have an 8-year life with the possibility of extensions at the end of the term. CircleUp takes a 0.5% management fee but no carry.

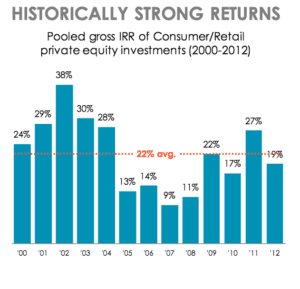

Why should you want to invest in Consumer-Retail companies? CircleUp points to data that shows historically strong returns over an extended period of time. Over a 12 year period of private equity investments in C/R, private equity investments delivered a 22% average IRR.

CircleUp forwarded a message to Crowdfund Insider on the new fund;

We’ve built a new product into our platform, our Marketplace Index Fund (MIX) that brings the ETF model to private equity for the first time, to our knowledge. It’s diversification across early-stage private for the price of an ETF, approximately 75% cheaper than this kind of diversification would cost otherwise. Rather than 2/20, we charge a 0.5% management fee and zero carry.

We’ve been testing out this product this year, and just closed a $4.25M fund after hitting the 99 shareholder seat limit (we closed oversubscribed based on number of seats available).

MIX Fund II is now raising. It has a $25K minimum to participate and provides investors diversification across up to 25 companies. MIX is built on our Classifier, CircleUp’s proprietary machine learning algorithm that evaluate PE opportunities based on an average of 92k data points, per company, to inform decisions. The Classifier is what makes a product with these economics possible in the first place”

It is interesting to note that a post on Forbes says CircleUp has given up on the idea of crowdfunding. According to the post;

“CircleUp, has given up on the idea of crowdfunding as a business and has quietly launched what it called the Marketplace Index Fund, which brings an ETF model to VC investing.”

Semantics aside, providing a vehicle to provide simple, immediate diversification is a natural evolutionary step in the world of internet finance. Multiple other platforms already do the same and you should expect more. Title II of the JOBS Act, or accredited crowdfunding, revolutionized finance by allowing general solicitation. Thus issuing companies could (finally) promote their investments online. No Zombie here. Investment crowdfunding is only starting.

Semantics aside, providing a vehicle to provide simple, immediate diversification is a natural evolutionary step in the world of internet finance. Multiple other platforms already do the same and you should expect more. Title II of the JOBS Act, or accredited crowdfunding, revolutionized finance by allowing general solicitation. Thus issuing companies could (finally) promote their investments online. No Zombie here. Investment crowdfunding is only starting.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!