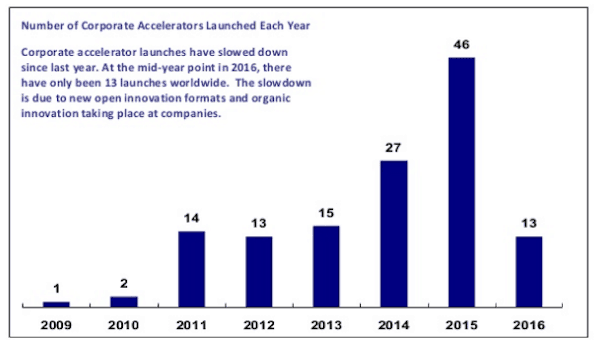

The number of corporate accelerators has grown dramatically in recent years with Fintech playing a central role. Corporate accelerators now number 131 globally with 13 launching this year. But this number represents a dramatic slow down versus last year when 46 accelerators launched. This is according to research provided by Falguni Desai of Future Asia Ventures.

Following in the footsteps of their previous reports, Future Asia Venture outlined the growth of corporate accelerators with a focus on Fintech. Presently the US leads with 31 corporate accelerators followed by the UK with 22 and then Germany with 12. Regarding Fintech, the report estimates there are about 6,000 Fintech startups globally but the question is asked, is this sustainable?

Desai expresses her opinion the Fintech boom may be at a peak as regulation and competition increases;

Desai expresses her opinion the Fintech boom may be at a peak as regulation and competition increases;

“In fintech, as with any sector, we expect there to be winners and losers. There are an estimated 6,000 fintech startups around the world. This is not sustainable. The coming years will naturally see a weeding out process as startups face regulatory hurdles, merge with other players or simply run out of capital without gaining traction.”

The hottest market for Fintech is Asia with more than half of the Fintech firms being based in the region – 2500 in China alone. Singapore is highlighted due to the government’s approach to incentivize an innovation-based economy;

“Asia holds great potential for fintech innovation. The region has a diverse mix of affluent, middle class, un-banked and under-banked migrant populations which need different types of financial services,” states Desai. “While the West might lead the world in B2B innovations that change institutional processes, Asia will likely lead in B2C fintech applications.”

Singapore aggressively subsidizes entrepreneurship. Co-funding programs will match up to $1 million in VC funding, and that is just a start. Singapore invests aggressively in startups embracing the fact that many will fail but the few that remain may become quite successful.

Singapore aggressively subsidizes entrepreneurship. Co-funding programs will match up to $1 million in VC funding, and that is just a start. Singapore invests aggressively in startups embracing the fact that many will fail but the few that remain may become quite successful.

“Singapore stands out as a truly proactive ecosystem with government programs, coworking spaces, accelerators and corporations working to encourage entrepreneurs. The ambition is palpable. The coming years will be critical as there needs to be a shift in mindset and culture. People need to embrace the risk that comes with following your own business vision. It requires leaving the security of a salaried job in a luxurious office tower.”

The deck “The Unsustainable Boom: Accelerators and Startups” by Future Asia Ventures is embedded below.

[slideshare id=63461817&doc=futureasiaventuresjune2016final-160626191001]