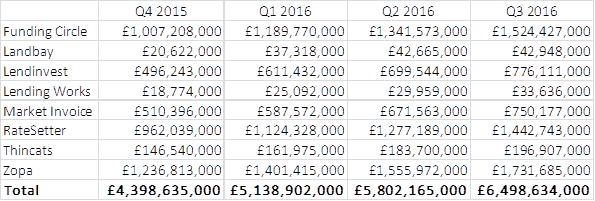

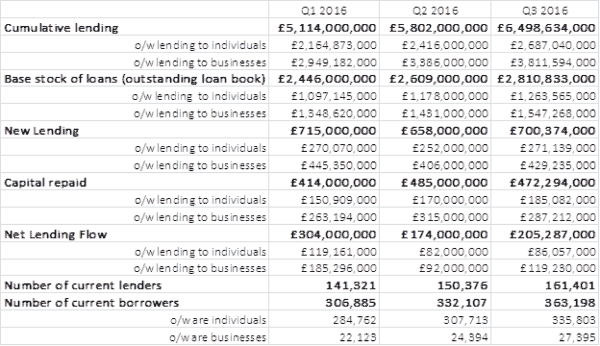

The UK Peer to Peer Finance Association (P2PFA) has released data for member platforms for Q3 2016. According to their numbers, new P2P loans hit £700,374,000 driving cumulative lending to just under £6.5 billion. Aggregate lending was an improvement over year prior quarter indicating ongoing industry growth. Zopa remained the largest P2P lender followed by Funding Circle and Ratesetter, a platform that is closing in on its peers.

The P2PFA represents the eight most established P2P lending platforms in the UK. Established in 2011, the self-regulatory body has set high standards of transparency and practices to help ensure a competitive and viable sector of finance.

Christine Farnish, Chair of the P2PFA released a comment on the Q3 report;

Christine Farnish, Chair of the P2PFA released a comment on the Q3 report;

“Data from the third quarter of 2016 highlight the strength of peer-to-peer lending in the United Kingdom, and underscore the value that this form of alternative finance is providing to the economy for borrowers – both business and consumer – as well as lenders. Peer-to-peer lending continues to deliver a competitive alternative to traditional lending.”

Reflecting on the recent speech by Lord Adair Turner, the former FSA Chair, Farnish stated;

“As Lord Turner said last week: at an accelerating pace, direct non-bank lending has extended to segments previously almost entirely dominated by banks. The direct lending industry will grow and play a useful role in our overall credit supply system.”

The P2P industry is in the midst of a regulatory review by the Financial Conduct Authority. Farnish and industry members have voiced the importance of the new form of finance for the UK economy as regulators review existing rules.