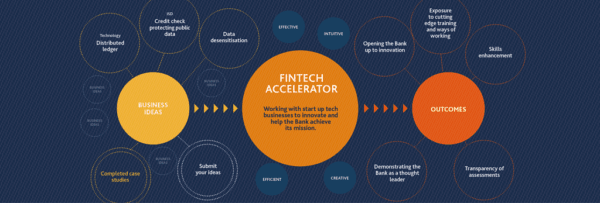

In a speech this past week by Charlotte Hogg, Chief Operating Office of the Bank of England, she welcomed the launch of the Bank’s Fintech Accelerator while explaining their mission.

Hogg stated;

“We set up the Bank’s Fintech Accelerator in the Bank, launched in June this year, precisely to develop our practical experience of Fintech. In the Accelerator, we seek to engage with a large number of Fintech firms and technologies, and to run a series of targeted, rapid proof of concepts (POCs) with a number of them. All POCs are work on problems or challenges that are important to us, and the firms are carefully chosen through an open process based on our published criteria…Recent POCs have covered three main areas – data analytics, information security, and some work exploring distributed ledgers.”

Hogg explained that new technologies present opportunities as well as risk. But it is the Bank’s goal to assess both while promoting what is good for consumers. Hogg envisions an mission where the Bank bridges the gap between institution and innovation.

Hogg said the Fintech Accelerator is not just about new tools and applications. It is about cultural change.

“For an institution to endure it needs to change with the times.”

The Bank of England was founded in 1694 making it the 2nd oldest institution of its kind (Sveriges Riksbank in Sweden is a few years older). Yet the Bank’s leadership does not see its advanced age as a reason to slow down and fight change. Noting that central banks can be very good at research, the Bank has taken the initiative and researched over 130 startups during the past six months. They have come to the conclusion they are lacking in experience. What better way to mitigate this shortcoming than bringing the disruptors in house?

The Bank of England was founded in 1694 making it the 2nd oldest institution of its kind (Sveriges Riksbank in Sweden is a few years older). Yet the Bank’s leadership does not see its advanced age as a reason to slow down and fight change. Noting that central banks can be very good at research, the Bank has taken the initiative and researched over 130 startups during the past six months. They have come to the conclusion they are lacking in experience. What better way to mitigate this shortcoming than bringing the disruptors in house?

The Bank of England is currently working with the following Fintech firms:

- BMLL: This machine learning platform provides access to historic full depth limit order book data. The BMLL platform aims to facilitate analysis and anomaly detection. We have agreed to test their alpha version for this Proof of Concept.

- Threat intelligence: As part of the Bank’s wider information security and threat intelligence work we have partnered with two firms – Anomali and ThreatConnect – that provide innovative technologies to collect, correlate, categorise and integrate security threat data. For this project, we have asked them to offer a solution to consolidate threat intelligence into a searchable repository that can optimise information collation, enrichment and sharing in support of a proactive intelligence-led defence strategy.

- Enforcd: In this proof of concept, we are using an analytic platform designed specifically to assess and draw out trends on regulatory enforcement action using publicly available information.

As a national agency, the Bank of England is not alone in embracing Fintech disruption. Just this past week Singapore announced it was opening the largest Fintech hub in the world. The most glaring omission on the list of nations promoting Fintech innovation is the US where many sectors of government engaged with financial services have chosen to observe from afar.

As a national agency, the Bank of England is not alone in embracing Fintech disruption. Just this past week Singapore announced it was opening the largest Fintech hub in the world. The most glaring omission on the list of nations promoting Fintech innovation is the US where many sectors of government engaged with financial services have chosen to observe from afar.

The Bank is currently accepting new applications.

The speech by Hogg is embedded below.

[scribd id=330782069 key=key-xKTpYHFLAR0I9bATLuNY mode=scroll]