The TABB Group recently published a research report entitled, Capital Reformation: Alternative Financing and the Fate of Intermediaries, part of this report discussed the emerging industry of crowdfunding and its impact on the finance industry in general.

The TABB Group recently published a research report entitled, Capital Reformation: Alternative Financing and the Fate of Intermediaries, part of this report discussed the emerging industry of crowdfunding and its impact on the finance industry in general.

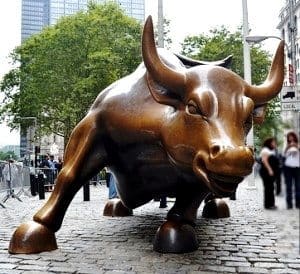

“Wall Street is No Longer a Protected Class”

A market research and strategic advisory firm focused on capital markets, TABB was founded in 2003 with the objective of helping senior business executives capture a better understanding of financial  markets issues and trends. They have deep experience with equity markets, fixed income, forex and derivatives. Reviewing the disruptive innovation of crowdfunding would be a natural project for their team since crowdfunding will, inevitably, impact all of these sectors of the finance industry.

markets issues and trends. They have deep experience with equity markets, fixed income, forex and derivatives. Reviewing the disruptive innovation of crowdfunding would be a natural project for their team since crowdfunding will, inevitably, impact all of these sectors of the finance industry.

The report was authored by Adam Sussman and Deepali Nigam, and they were kind enough to share a copy with Crowdfund Insider.

This is a well written and very insightful discourse on capital markets. Sussman and Nigam estimate that presently alternative financing raises $47 billion globally for SMEs, but they expect this number to grow rapidly, estimating it could hit $150 billion within the next three years. The market could quickly grow to $300 billion according to the report. This incredible growth will be driven by further disintermediation which is a natural outcome due to the regulatory environment, capital demand and the growing psychology that,

…intermediaries are a growing source of market abuse, rather than a layer of investor protection. Thus, tearing down the walls between counterparties is viewed as shedding skin that no longer serves a purpose. Wall Street is no longer a protected class.

The report acknowledges that technology is allowing for greater engagement from investors and new business models are rising rapidly. This is being compounded by the regulatory environment in both the United States and in Europe. As regulatory costs rise – and they have risen dramatically over the past few years – shear economics push businesses to look for alternatives. Traditionally SMEs have gone for bank loans for funding, but this has become too expensive. From the equity perspective the costs have become an enormous barrier for businesses,

rising rapidly. This is being compounded by the regulatory environment in both the United States and in Europe. As regulatory costs rise – and they have risen dramatically over the past few years – shear economics push businesses to look for alternatives. Traditionally SMEs have gone for bank loans for funding, but this has become too expensive. From the equity perspective the costs have become an enormous barrier for businesses,

…the average one time cost to carry out an IPO which aims to raise between $1 Million to $50 Million is $4.1 Million

The Jobs Act was intended to provide relief for this new reality. The Sussman / Nigam report accepts change as a necessity as the growth of the economy is dependent on these small businesses.

“Emerging alternative finance structure will be critical to filling the SME funding gap.”

Perhaps this is a situation where a crisis is not wasted and “regulation leads to innovation”. For participants in the finance sector this document is a must read. Debt and equity markets will experience disruption over the coming years. The perspective and data provided in this report should hopefully allow firms able to adapt the additional insight necessary to move forward now.