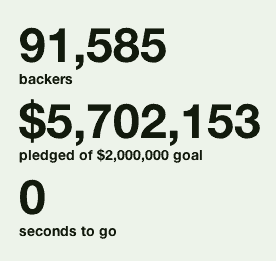

After the success of Rob Thomas’ efforts to crowdfund a Veronica Mars movie through Kickstarter, it was inevitable that some other auteur with a significant fanbase would follow his lead. That person is now Zach Braff, who as of this writing has raised about $954,000 out of a $2 million goal to make Wish I Was Here, a movie he’s described as a follow-up to Garden State. Not surprisingly, a lot of people are irked, mostly on the grounds that Braff is rich and could have, in their estimation, funded the project himself. I’m less certain of that, because in my experience, even having a lot of money by normal-person standards doesn’t allow you to fund a string of high-quality Hollywood productions, and I understand the desire to look for a funding base you could go back to time and time again. But I am anxious about the idea that Hollywood projects will start flocking to Kickstarter in droves to get financing for another reason: we’re a long way from making sure that these arrangements will be truly fair to fans who are investing in their dream projects.

After the success of Rob Thomas’ efforts to crowdfund a Veronica Mars movie through Kickstarter, it was inevitable that some other auteur with a significant fanbase would follow his lead. That person is now Zach Braff, who as of this writing has raised about $954,000 out of a $2 million goal to make Wish I Was Here, a movie he’s described as a follow-up to Garden State. Not surprisingly, a lot of people are irked, mostly on the grounds that Braff is rich and could have, in their estimation, funded the project himself. I’m less certain of that, because in my experience, even having a lot of money by normal-person standards doesn’t allow you to fund a string of high-quality Hollywood productions, and I understand the desire to look for a funding base you could go back to time and time again. But I am anxious about the idea that Hollywood projects will start flocking to Kickstarter in droves to get financing for another reason: we’re a long way from making sure that these arrangements will be truly fair to fans who are investing in their dream projects.

Movie projects aren’t the only businesses where crowdfunding is increasingly seen as an attractive alternative to other funding options. As Kylie MacLellan wrote earlier this month, “As banks rein in lending due to tougher capital rules and greater regulatory scrutiny, crowdfunding, which originated in the United States as a way to raise money for creative projects, has expanded rapidly as an alternative source of finance.” But even though President Obama in 2012 signed into law a bill that would pave the way for crowdfunders to get equity in the projects they invest in, the Securities and Exchange Commission has yet to complete writing the rules that would regulate that process. That means there’s still no legal pathway for people who contribute to projects through Kickstarter or through other portals to get equity in said projects, or for the people who set up those projects to give equity to them. There are powerful interests, including venture capital firms, who would prefer not to see crowdfunding become an alternative to them. And apparently the SEC has concerns, including about fraud, that it’s still resolving in its rule-writing process.